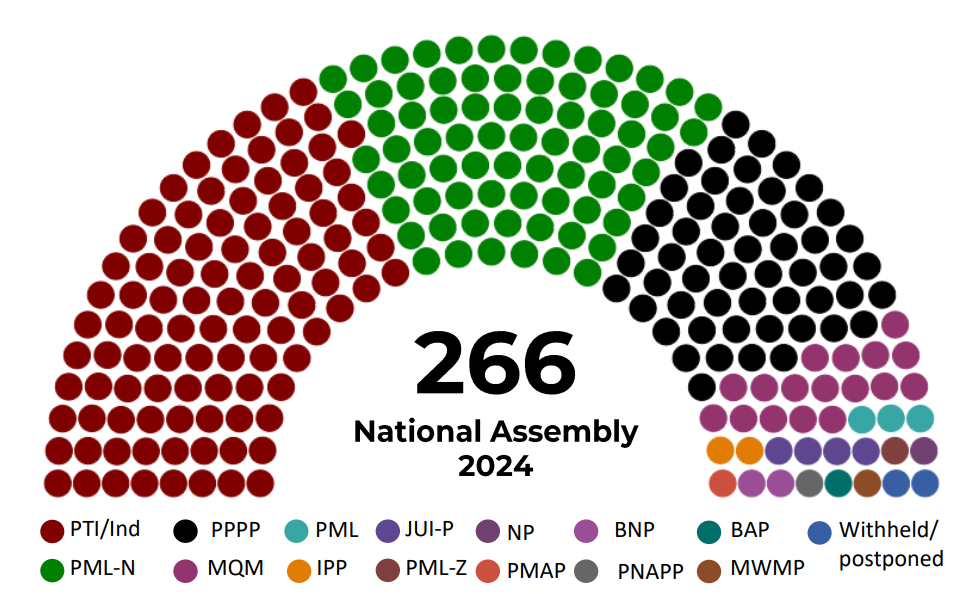

After an eventful week, the general elections in Pakistan have finally wrapped up. As the final numbers unraveled, it became evident that the electoral mandate was divided, with no single party commanding a clear majority for government formation. Consequently, the result remains uncertain, leaving the nation in a state of anticipation as they contemplate the future of their leadership. Multiple possibilities exist, including a high likelihood of a resurgence of the PDM coalition government. This coalition had previously governed the country from April 2022 to August 2023 before handing over power to a caretaker government, which then took nearly six months to conduct the general elections.

The clarity on whether there will be continuity or a significant change in leadership hinges upon the ongoing negotiations between different parties and the final verdict of the contested polling results in Pakistan’s higher courts. Nonetheless, the eruption of protests in response to the election results is likely to add to the instability predicament. The outcome of this situation holds significant consequences for Pakistan’s economy, which has been impacted by multiple external shocks and policy discontinuity in the past two years.

The Economy at Crossroads

The lack of political cohesion has left policy development in limbo, as short-sighted populist measures have taken priority over economically sound decision-making. As a result, the country’s foreign reserves currently stand at approximately USD 8 billion, providing nearly 1.5 months of import cover. Inflation in the previous calendar year averaged close to 30%, ranking among the highest in Asia. The Pakistani rupee has depreciated by almost 40% over the past two years, while the federal government faces the challenge of managing an external debt exceeding USD 100 billion.

On top of it, Pakistan is in the process of seeking another long-term IMF program as the current USD 3 billion stand-by agreement is set to expire next month. One of the prerequisites for this program is the presence of a stable, democratically elected government.

But is that even consequential for the startup ecosystem? The answer is a resounding Yes.

Fallout for the Startups

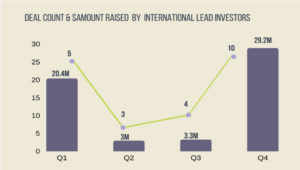

The startups, similar to other businesses in the country, depend on economic stability, which is directly influenced by political cohesion. Additionally, similar to other foreign investors, international venture capital is also hesitant to invest in the market due to the insatiable macroeconomic conditions, amplifying the risks associated with investing. It is crucial to recognize that there is always potential for a reallocation of funds toward other emerging markets if the conditions in Pakistan are perceived as unfavorable.

The Rupee’s Rollercoaster

Take, for instance, the case of the Pakistani rupee. Due to a flawed policy of pegging the exchange rate, the currency was overvalued for years. However, when the policy was abandoned, there was a sharp decline in the value of the rupee. As a consequence, foreign investors who had invested in the country’s startups had to write down the valuation of their portfolio assets. This adjustment was necessary as the cash flows and earnings of businesses experienced a significant decline when translating from rupees to USD.

USD | Year 2023

Interest Rates, Inflation, and Dual Hardships

Source: JS Global

Navigating Beyond the Haze

Interestingly, there exists a silver lining to this situation. Pakistan’s startup ecosystem is still in its early stages, and while funding may appear to have dried up it has actually normalized since the peak experienced in 2021-22, which coincided with a global surge in venture funding. Though facing considerable challenges, this period of reorientation presents an opportunity for the emergence of more sustainable business models and a clear path to profitability.

By placing greater emphasis on policy continuity at the macro level, the necessary impetus can be provided for the ecosystem not only to recover but also to scale regionally – which represents the next frontier for many startups in Pakistan.

This post is published by the Insights team at Invest2Innovate.