Welcome to our latest quarterly deal flow update for Q2 2024!

The spoiler

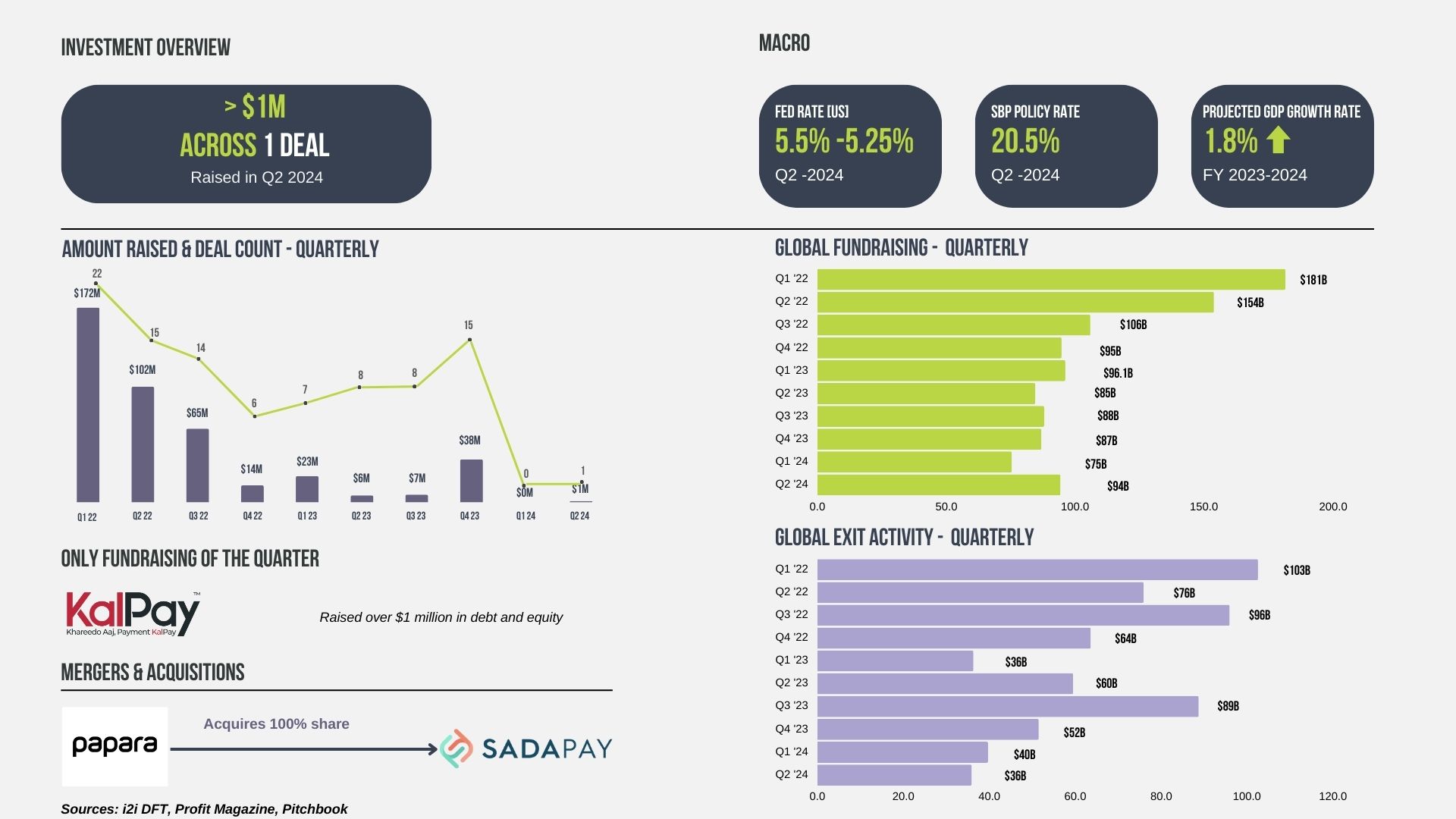

The fundraising landscape remains stagnant. This quarter saw just one deal, marking another slow period for Pakistan’s startup ecosystem. The drought continues, with capital flow at a near standstill, leaving many startups eager for relief.

Since we began tracking Pakistan’s funding trends in 2015, we’ve navigated plenty of highs and lows. But 2024 is shaping up to be unlike any other year. We’re in unfamiliar waters, facing a prolonged downturn that’s as rare as spotting a unicorn.

Investors remain cautious, standing on the sidelines as they assess the ongoing political instability and economic challenges. The recovery looks to be a long road ahead.

On the macroeconomic front, the federal budget took center stage this quarter. While it’s aimed at fiscal recalibration and securing a long-term IMF program, it lacks sufficient measures to stimulate growth. As a result, the suppressed demand across sectors continues to weigh heavily on businesses.

While Quarter 1 saw a muted deal activity with no funds raised, in Quarter 2, Pakistani startups raised over $1 million across 1 publicly disclosed deal, marking a stark contrast to the total funding amount of approximately $1005.43 million across 354 deals since 2015.

Global Comparison

Global venture funding saw a slight uptick in the second quarter of 2024, According to Pitchbook, funding levels reached $94 billion, exceeding the amounts raised in the last quarter.

Regional Comparison

The MENA region also sustained its fundraising momentum, having raised $336.4 million across 59 deals in April and May of 2024;

- Saudi Arabia raised $60.8 million across 13 deals

- UAE raised $221 million across 29 deals

- Egypt raised $33.2 million across 9 deals

(As of the time of writing, data on MENA fundraising for June was not accessible)

The region’s robust fundraising performance has been driven by a flurry of new venture funds launching, setting up their base in the Middle East, most notably in Saudi Arabia. While another notable trend was an uptick in late-stage funding rounds.

Investor Activity

Globally, investor activity remains subdued as the tricky macroeconomic environment persists. While it was expected that central banks would start cutting interest rates from the second quarter onwards, reality has proven different.

Central bankers, especially in developed economies like the US and UK, have been very cautious about lowering borrowing costs. This caution is likely to keep venture funding growth in check, as alternative asset classes continue to offer attractive returns.

On the domestic front, the State Bank of Pakistan opted for a rate cut for the first time in four years, bringing the policy rate down to 20.5% However, this rate remains too high to encourage any significant domestic capital flow towards riskier early-stage ventures.

Projections suggest that the interest rate may decrease to 16% over the next 12 months. However, a recovery in investment activity might not gain momentum until the country’s foreign exchange liquidity crisis is addressed.

That said, there’s cautious optimism that the current funding lull might be nearing its end, with a slight uptick in investment activity expected in the second half of the year.

Mergers and Acquisitions

Turkish neobank, Papara, officially announced its acquisition of Sadapay, marking a significant development in the fintech sector this quarter.

The transaction structure is noteworthy: Papara invested $10 million directly into Sadapay, resulting in a dilution of existing shareholders. Additionally, Papara acquired the remaining equity from Sadapay’s shareholders for $40 million, with the consideration being in the form of Papara’s own equity.

Finding a Way Out

Amid the prolonged funding drought, many startups may be feeling the strain. Fatigue is inevitable, but those that persevere through this challenging phase are likely to emerge stronger, with resilient and sustainable business models primed for future growth.

For startups struggling to secure traditional funding, exploring subsidized financing options can provide much-needed relief. Impact investors, for example, are offering loans at significantly lower rates than the policy benchmark. Additionally, aligning your startup’s mission with the UNDP’s Sustainable Development Goals (SDGs) can attract patient capital and long-term investment.

However, founders should remain cautious. Raising capital solely to stay afloat can be risky, and in some cases, accepting a down round may be a smarter move. In terms of strategy, focusing on regional expansion—building locally in Pakistan and then scaling across the region—appears to be a promising path forward in the current market climate.

See You in Q3!

Startups often get flak for not meeting investor expectations, but let’s not forget that the regulatory impediments are also part of the equation and part of the problem as well.

For example, the process of establishing a venture or private equity fund in Pakistan would expose you to the worst type of red tape. Moreover, efforts to mitigate the risks associated with foreign investments in startups have been limited and lacking in firm commitment.

The potential enhancements in the ecosystem may not come to fruition without significant structural changes and proactive measures such as seen with Bangladesh’s fund of funds.

Further, the regulator must incentivize domestic capital to shift towards more productive endeavors rather than being entangled in rent-seeking activities.

We hope you found this update useful and look forward to seeing you next time. Sign up for our newsletter for more investment updates!