In Pakistan’s startup ecosystem, we’ve always celebrated the ability to turn limited resources into great outcomes. However, this year has presented unprecedented challenges. The IMF has projected economic growth of just 0.5%, down sharply from 6% in 2022. Globally, growth is expected to decelerate from 3.4% in 2022 to 2.9% in 2023. This economic slowdown has already impacted investments across all markets, with global VC funding experiencing a 53% YoY drop in Q1 2023. For Pakistani startups, the road ahead is even steeper due to a combination of global and national economic hurdles.

This quarter was also marked by significant political uncertainty. The arrest of ex-Prime Minister Imran Khan led to a nationwide digital blackout, which is particularly damaging for startups. In countries with internet shutdowns, startups experience 2.2% more losses on average compared to those in stable environments. This instability compounds the fragility of our ecosystem, which is already grappling with the risk of a balance of payment crisis, a high likelihood of debt default, and a weakening currency.

The fallout has been severe. Funding for startups in Q2 2023 dropped 94% compared to the same quarter last year.

The 2023-2024 budget offered little relief. Initially falling short of the IMF’s expectations, the government revised the budget, leading to a staff-level agreement for a $3 billion bailout package. While the final decision on disbursement is expected in mid-July, this brings a glimmer of hope to the business community, which is in dire need of stability.

Despite the tough conditions, remember: investing is about playing the long game. Now, let’s dive into our quarterly deal flow update for Q2 2023!

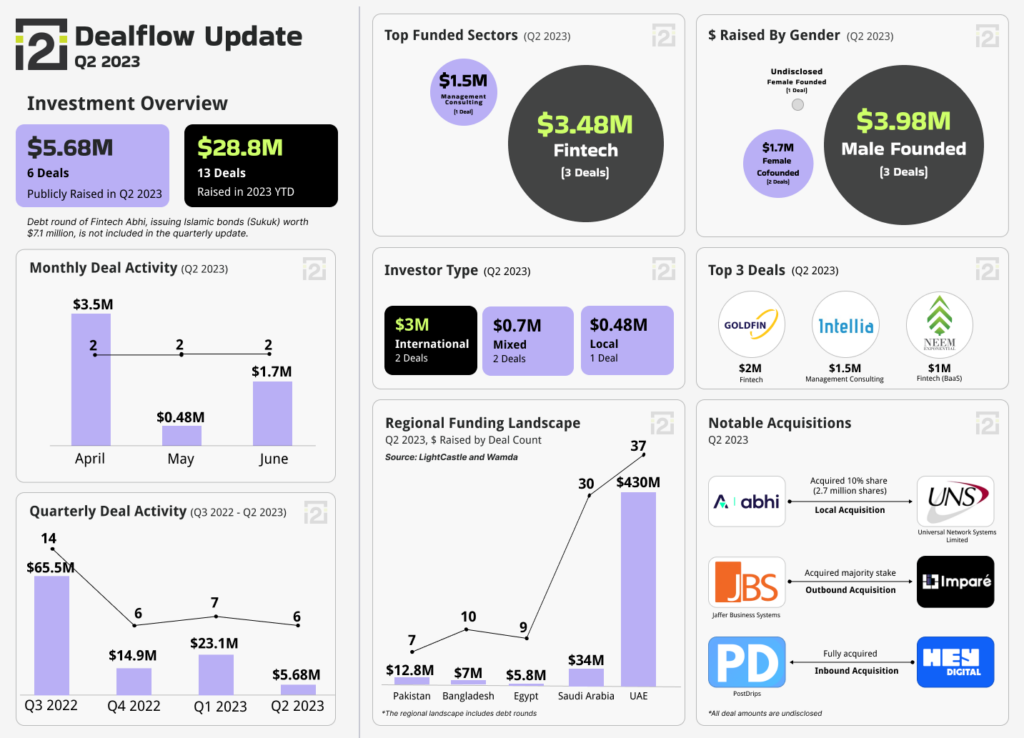

Q2 Funding Overview

Pakistani startups raised $5.68 million across 6 publicly disclosed deals, bringing the total funding amount since 2015 to approximately $953 million across 329 deals. This quarter marked the lowest funding level in 12 quarters, with the last comparable figure being $5.3 million in Q1 2020. Compared to the previous quarter, the funding amount dropped 75%, with the deal count decreasing slightly from 7 to 6.

🌍 Regional Comparison

Amid adverse global economic conditions, regional counterparts also saw sharp declines in startup funding this quarter:

- Bangladesh: $7M across 10 deals

- Egypt: $5.8M across 9 deals

- Saudi Arabia: $34M across 30 deals

- UAE: $430M across 37 deals

Religious observances like Ramadan and Hajj in April and June likely contributed to the slowdown in funding across Muslim-majority countries. However, if inflationary pressures ease and interest rates stabilize, we could see an uptick in funding and investor confidence in Q3 and Q4.

💰 Reported Deals This Quarter

- April:

- Goldfin: Raised $2 million from Insitor Impact Asia Fund

- Intellia: Raised $1.5 million in a pre-seed round

- May:

- BizB: Raised an undisclosed amount in a pre-seed round

- QistBazaar: Raised PKR 140 million ($0.48 million) in a corporate round from Bank Alfalah

- June:

- OkayKer: Raised $0.7 million in a seed round

- Neem: Raised $1 million in a seed extension round

For a detailed breakdown of reported deals, visit i2i’s Deal Flow Tracker (DFT).

🧮 Highest Funded Sectors

Fintech remains the shining star across the MENAP region. Investments in the sector have grown by 36% annually between 2017 and 2022, with revenues projected to reach $3.5 billion to $4.5 billion by 2025. In Pakistan, fintech led the way again this quarter, raising $3.48 million. Fintech not only dominated deal flow but also saw notable achievements, such as Abhi’s acquisition and debt financing efforts.

👫 Founder Gender Diversity

Gender diversity in startup funding showed improvement this quarter. While Q1 2023 saw only one female-cofounded deal, this quarter recorded 2 female-cofounded and 1 female-founded deal. Among the 5 publicly disclosed deals, 70% of the funds were raised by male-founded startups, and 30% were raised by female-cofounded startups.

- Male-founded startups: Raised $3.98 million across 3 deals

- Female-cofounded startups: Raised $1.7 million across 2 deals

- Female-founded startup: Raised an undisclosed amount in 1 deal

💰 Investor Activity

Investor confidence remains low due to economic instability and the withdrawal of foreign companies from Pakistan. International investor participation dropped by 43% compared to Q1 2023.

🔀 New Sources of Funding

In response to the challenging economic climate, startups are diversifying their funding sources. Fintech Abhi issued Sukuk bonds worth $7.1 million, introducing Islamic finance as a new funding line. Sukuk bonds offer startups access to higher-yield capital with more predictable returns.

Additionally, Bank Alfalah entered the venture capital ecosystem by acquiring a 7.2% equity stake in BNPL fintech QistBazaar. This collaboration exemplifies how banks and fintechs can work together to enhance user experience and digital financial services.

👉 Mergers and Acquisitions

There were 3 notable acquisitions this quarter:

- Fingistics: Abhi x Blue-Ex

- Abhi acquired equity in courier company Universal Network Systems Limited (BlueEx).

- DigitAIze: HeyDigital x PostDrips

- Estonia-based HeyDigital acquired Usama Khalid’s AI-powered LinkedIn Scheduler platform, PostDrips.

- IT: Jaffer Business Systems (JBS) x Impare

- Pakistani IT firm JBS acquired a majority stake in Silicon Valley-based chip verification startup, Impare, marking JBS’s first international startup investment.

👋 Looking Ahead to Q3

As we head into the second half of 2023, we remain cautiously optimistic. While deal flow has slowed, the ecosystem continues to breathe through acquisitions and creative funding strategies. In challenging times, innovation is key, and we are confident that the ecosystem will remain resilient as it navigates the road ahead.