Introduction

In the world of business and technology, the gender parity debate has been rehashed many times without a lot of action contributing toward change. This disparity extends to the startup ecosystem, where female founders secure a mere fraction of the deals and funding enjoyed by their male counterparts. As we delve into the crucial factors behind this gender gap, we will also highlight actionable steps that investors and founders can take to level the playing field and unleash the full potential of women-led startups.

To gain a better understanding of the persistent gender funding gap, our team took a closer look at the investment landscape.

TL;DR

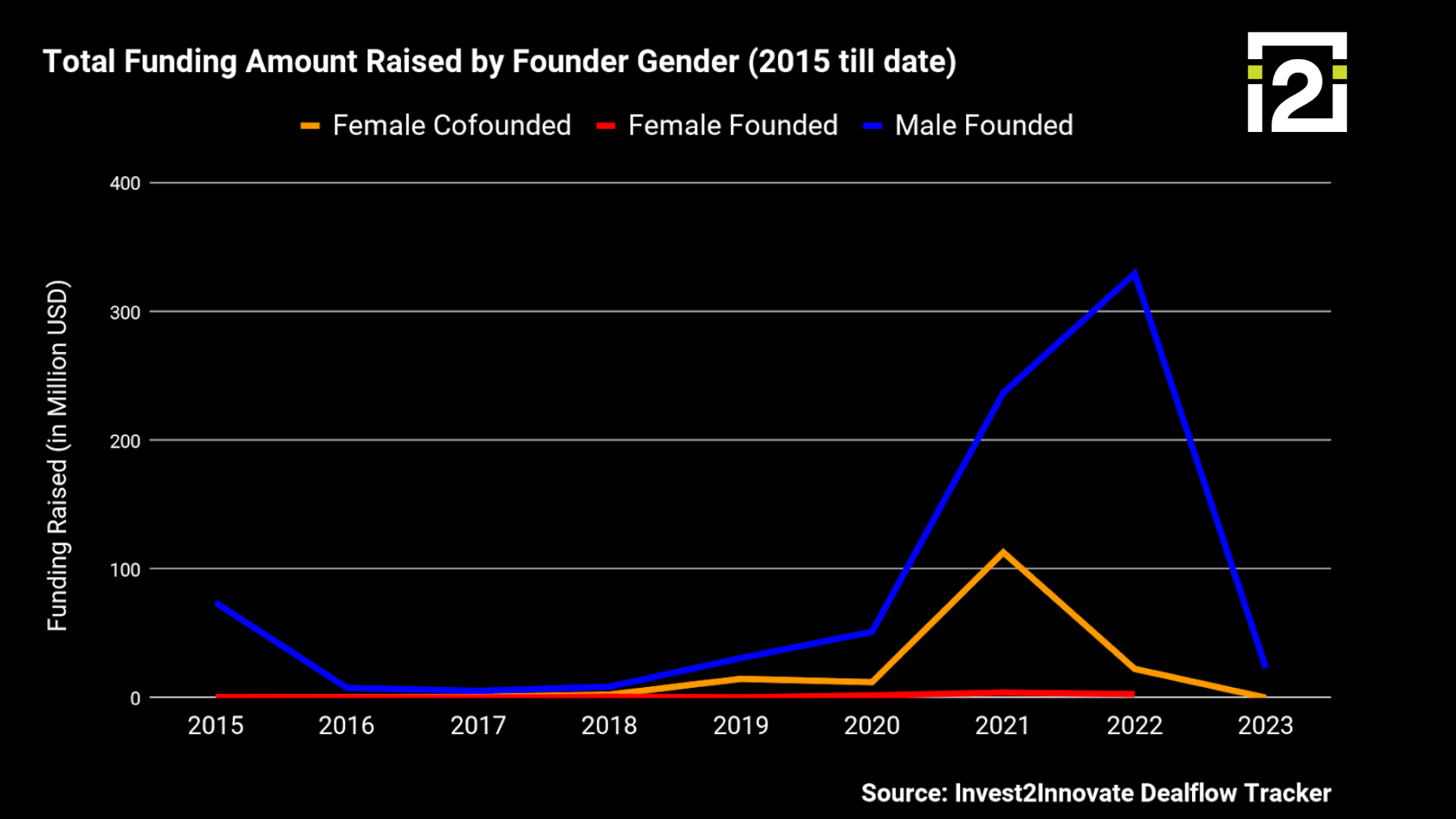

- In 2022, female-founded and co-founded companies raised only 8% of the total startup funding in Pakistan and secured less than 6% in the MENAP region.

- Deals closed by female-only founded companies have remained flat since 2020 at three deals per year.

- Between 2020 and 2022, on average, for every dollar invested in a male-founded startup, female-founded and co-founded startups raised only 29 cents in the angel/pre-seed round and 55 cents in the seed round.

(If you want a dive deep into the numbers, there’s more in the last blog)

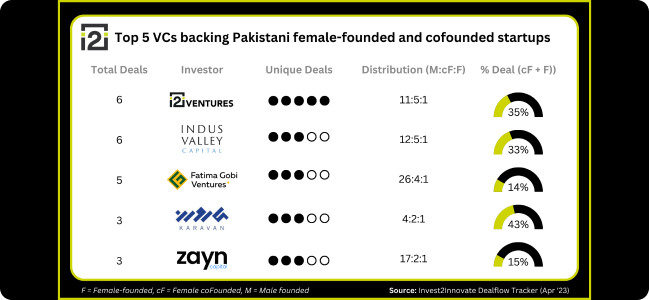

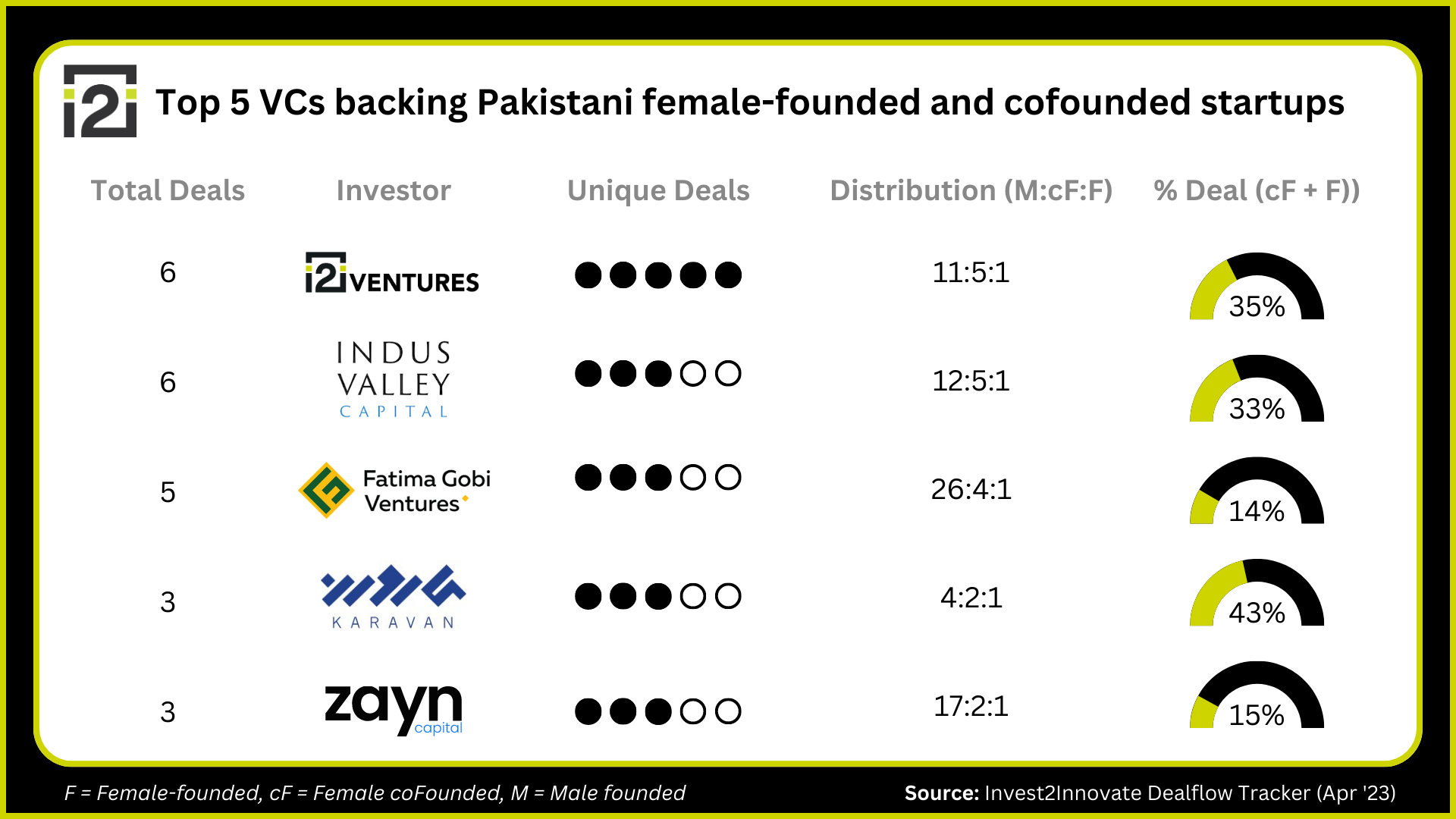

Our analysis of the active VCs and angel investors in Pakistan revealed that i2i Ventures and Indus Valley Capital have closed the most number of deals with female-founded and co-founded companies. Among them, i2i Ventures – our sister entity and the only female-founded VC firm in Pakistan – had the highest number of unique deals. Additionally, Karavan, with a mixed-gender VC team, had the most diversified deal distribution. However, despite these positive developments, the portfolio ratio of even the most active VC firms still falls short, with only one deal being closed with a female-founded startup per firm.

Why Does the Gender Funding Gap Persist?

Our Pakistan Startup Ecosystem Report (PSER), published last year, explored the challenges and solutions in detail. Some of the reasons most cited by decision-makers are:

The Pipeline Problem

Often cited as the main challenge, the limited number of female-founded startups significantly contributes to the funding gap. These businesses are usually seen as low-growth and fit for low-risk capital.

Homophily in Networking

Evidence suggests that 80% of VCs’ deal flow comes through referrals. But gaining access to the VC network, dominated by men, is often challenging for female founders and those from disadvantaged backgrounds. Not having a warm intro can be the difference between success and failure.

The Female VC Dilemma

The lack of female VCs and angels is cited as a reason for the gender funding gap, but it’s a chicken-and-egg problem. Structural inequities lead to fewer women pursuing STEM fields. Even when they overcome this challenge, gaining a seat at the VC table is difficult due to small teams and low turnover. Moreover, increasing the number of female VCs may help address this issue partially, but biases may still exist. Research suggests that both male and female VCs exhibit similar biases toward female founders.

Addressing Bias

Implicit bias is often swept under the rug in discussions about gender funding. Assuming that a female founder started a business as a “passion project” or a side “hustle” is often viewed negatively, with further assumptions that they will quit midway because of familial responsibilities. Holding stereotypical gender views is unacceptable if you are a decision-maker. As Halima Iqbal, founder of Oraan, emphasized during her PSER interview, “You cannot question somebody’s ambition based on their gender.” Evidence also shows that evaluators mark down pitches when feminine traits are displayed, regardless of the presenter’s gender.

Steps Investors Can Take to Close the Gap

Acknowledge

The first step towards addressing the gender funding gap is acknowledging its existence. The intention is not to compel investors to favor female-led startups or alter their investment thesis, but rather to prevent perpetuating bias.

Sourcing Deal Flow

Partnering with Ecosystem Support Organizations (ESOs) can diversify VCs’ and Angels’ referral sources and identify potential female-founded startups for their pipeline. This can also provide timely feedback to ESOs and improve the quality of leads. Further, to avoid the pitfalls of like-minded networking and to attract quality leads outside their network, VCs and Angels can advertise their office hours and showcase their investment thesis and portfolio on public profiles.

The Screening Process

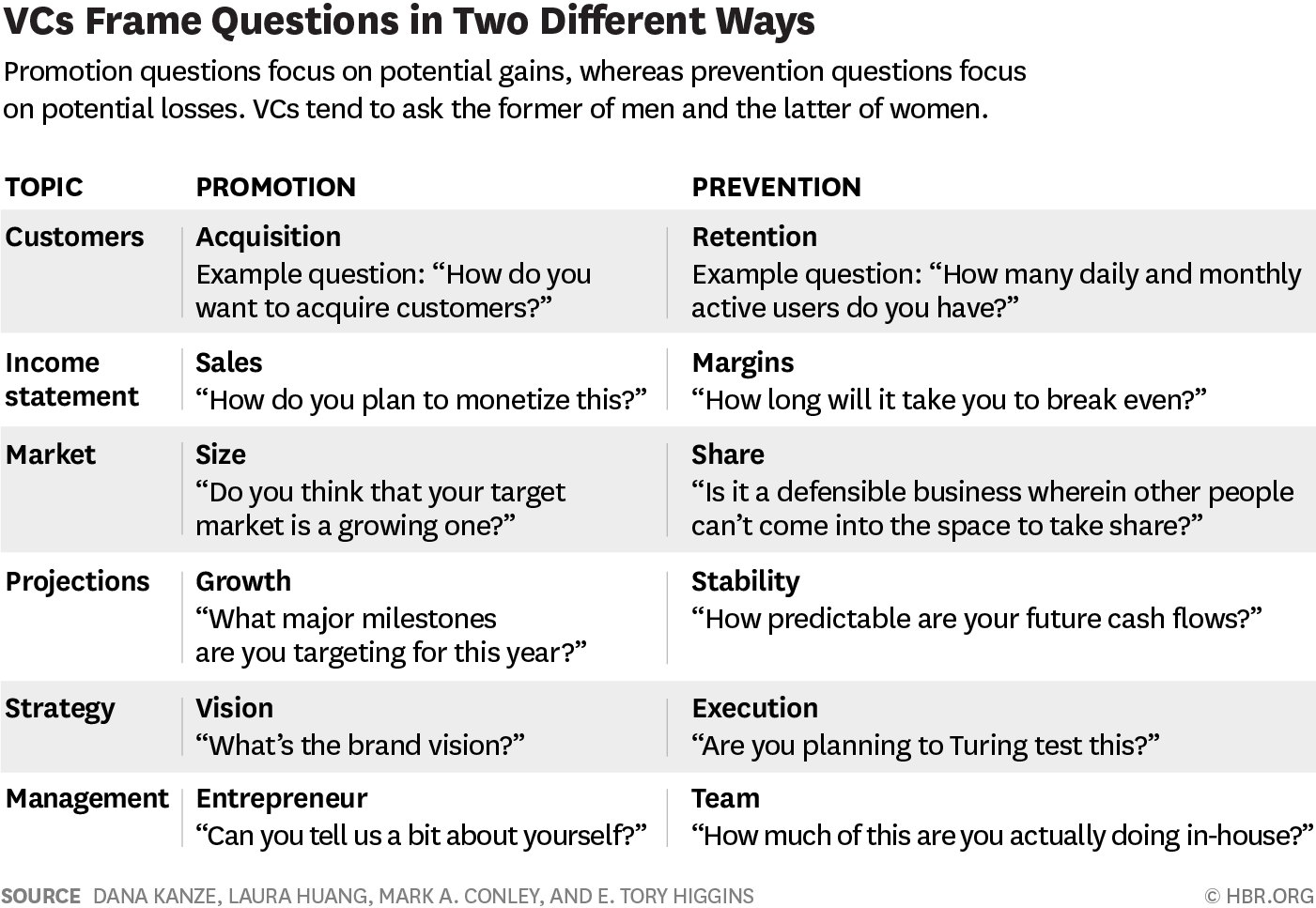

The language used during the screening process can perpetuate gender stereotypes and limit funding opportunities for female founders. According to Dana Kanze’s research, investors tend to ask more “preventional” questions from female founders, while male founders are asked more “promotional questions.” This language difference can emphasize potential risks and downsides of a company, rather than highlighting its potential gains and achievements.

What can you do as a VC/Angel to address this subtle but significant bias?

- Reflect on Biases: Investors should reflect on past investments to identify patterns or biases that may have influenced their choices.

- Ask Balanced Questions: Ask balanced questions that highlight both the potential risks and opportunities of a startup to avoid gender stereotypes.

- Provide Feedback: Beware of the language used by female founders during their pitch and encourage them to emphasize the potential gains of their business.

VC Team

Consider incorporating diversity at all levels of the investment team, including junior staff responsible for sourcing and screening deals, as well as senior members of the investment committee who make final investment decisions. Provide gender sensitivity training and learning sessions on biases to help team members recognize and address their own biases. In cases where immediate team diversification may prove challenging, consider volunteering your time to mentor and guide female professionals and founders interested in entering the field, as this can also contribute to the larger narrative of addressing gender bias in venture capital.

Broadening the Definition of an “Ideal Founder”

To broaden the definition of an “ideal founder” build an internal founder checklist during the screening process. This checklist should not be a simple tick-in-a-box exercise but rather a brainstorming session and workshop where team members discuss and share their views on what makes an “ideal founder.” This can help minimize individual biases and ensure investment decisions are based on a diverse and inclusive perspective. The checklist could include items such as coachability, industry experience, startup experience, technical skills, leadership, complementarity, passion and hunger, and diversity of perspectives. By using this checklist, all founding teams, regardless of gender, can be evaluated consistently and fairly.

How Can Female Founders Take Control?

Ask for Money

Female founders often hesitate to raise funds, opting to bootstrap or use other funding sources. Reevaluate your company needs and seek mentor support when going through startup valuation and generating your ASK.

Diversify Your Network

Show up and introduce yourself, and don’t be afraid to drop a LinkedIn message.

Be Mindful of the Language You Use

When pitching your company or answering investor questions, use promotional language even when asked a prevention question. Evidence clearly shows that language can play a huge role in the process of closing a deal and raising your targeted amount.

We at Invest2Innovate are committed to actively working toward the change that we wish to see in the ecosystem. We are always open to feedback and suggestions. If you have any meaningful comments or feedback, feel free to drop us an email.

This blog was co-authored by Cyrine Ben Fadhel, a venture capital investor at Global Ventures and Sarwat Rattani from the Insights team at Invest2Innovate.