Introduction

When considering Pakistani startups, you might think of fintechs, ride-hailing services, last-mile delivery apps, and well-known e-commerce platforms. An electric vehicle (EV) startup, however, is probably not the first thing that comes to mind. This lack of immediate association reflects the slow progress of electric mobility in the country, despite its evident potential and need.

Across the Indus

Promising Developments in India

Before we delve into Pakistan’s electric bike market, let’s look at the progress across the border in India. The future looks promising for electric two-wheelers, including motorcycles and scooters, which are a significant component of India’s transportation landscape. Representing over 70% of all vehicles, electric two-wheelers are anticipated to make up 60-70% of new vehicle sales in India by 2030, according to a McKinsey study. Consumers are not only willing to adopt more electric two-wheelers but are also embracing omnichannel purchasing experiences.

Pakistan’s Electric Vehicle Landscape

Current State of EVs

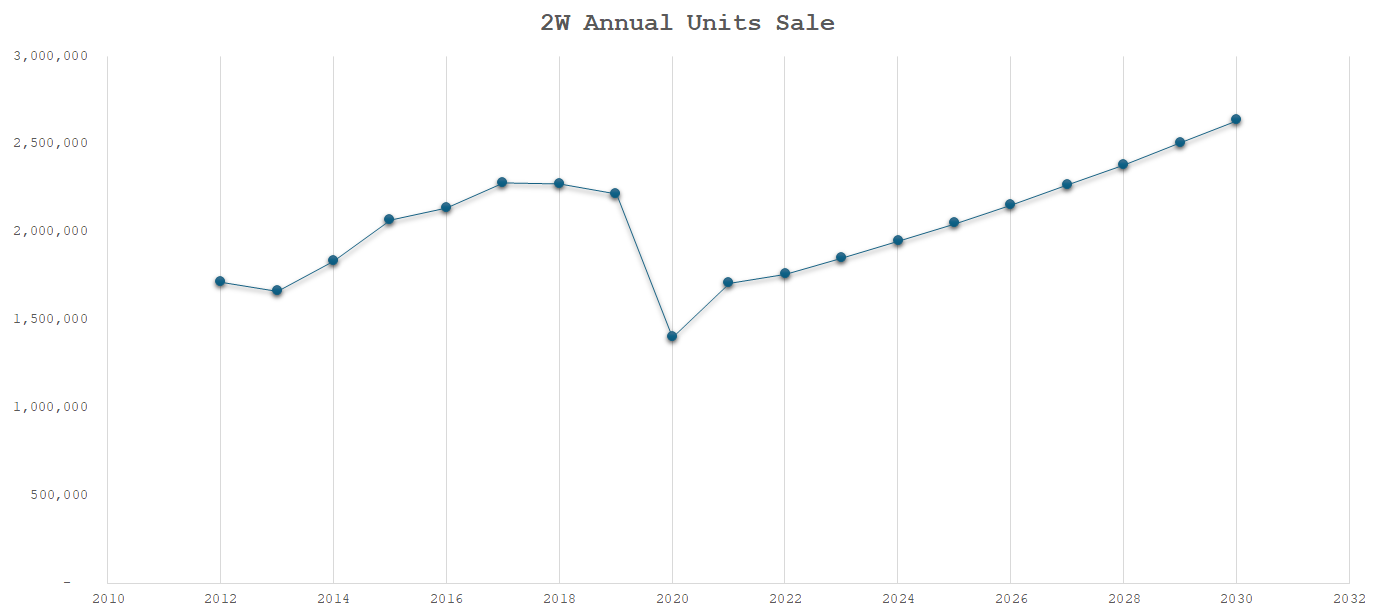

Pakistan presents a contrasting picture when it comes to electric two-wheelers. With fewer than 15,000 EVs on the road compared to the 26 million two-wheelers, there is both an opportunity and a concern. The two-wheeler market is substantial, with annual sales exceeding 1.5 million units consistently for the past decade and projections indicating this figure will surpass 2 million units each year. Despite this, electric two-wheelers currently make up only a negligible fraction of the market. However, recent developments have seen numerous companies entering this segment, with 30 of them receiving licenses from the Engineering Development Board (EDB).

Potential for Rapid Electrification

The potential for rapid electrification and emission reduction within the two-wheeler industry is significant. By analyzing growth trends, total cost of ownership (TCO), technological advancements, and consumer attitudes, we can pinpoint crucial factors that will drive the success of Original Equipment Manufacturers (OEMs) and other stakeholders in this domain.

Challenges to EV Adoption

Consumer Perspective

Purchasing a vehicle is a significant decision influenced by affordability, brand trust, convenience, and maintenance costs. Brand trust can be established over time as the market evolves and consumers become more informed. However, a major obstacle remains affordability. The current fleet of EVs is more expensive than their internal combustion engine (ICE) counterparts due to heavy reliance on imported automotive components. The battery, which comprises half of an electric two-wheeler’s price, is exclusively imported. Additionally, the scarcity of ancillary infrastructure, particularly charging stations, exacerbates consumer range anxiety.

Supply Side Challenges

The supply side faces several challenges, including reliance on imported components, high import tariffs for specific parts, and disruptions in the supply chain. These factors hinder production and escalate costs for manufacturers. Furthermore, the scarcity of a skilled workforce poses a significant obstacle to industrial growth. The absence of comprehensive training programs and educational opportunities restricts the availability of qualified personnel for manufacturing, maintenance, and repair.

Source: PRIED

Solutions for Revitalizing the Sector

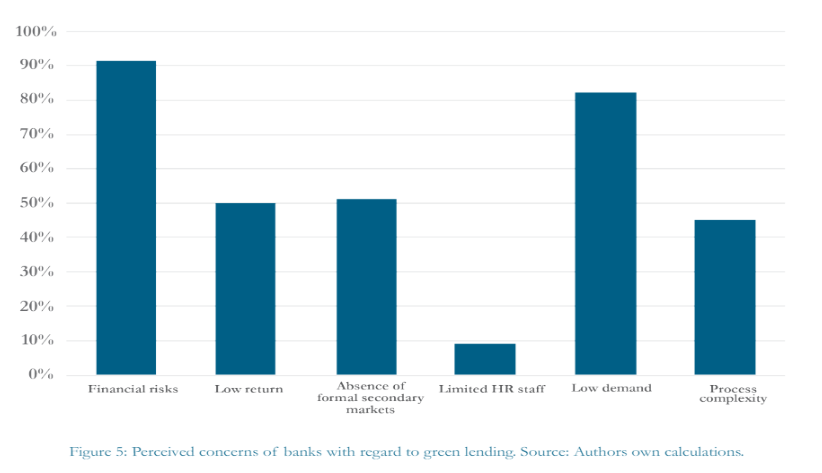

Financing and Infrastructure Development

Two key areas warrant attention: financing and infrastructure development. The current financing landscape of local banks largely overlooks consumer financing due to their risk-averse mindset, restricting consumer financing opportunities and playing into the affordability conundrum. EVs are capital-intensive, with funding requirements exceeding those of conventional technology businesses. While local venture capitalists (VCs) are primarily interested in early-stage startups, their ability to provide funding is limited by ticket size. Participating in subsequent funding rounds becomes increasingly challenging for them, leading to investor fatigue when it comes to EV startups. Concessional and grant funding, supported by multilateral donors and government mechanisms, can help fill the funding gap.

Infrastructure for EVs

Establishing battery charging and swapping stations is essential for the EV ecosystem. To execute this, key parts of EVs, including batteries, need to be commoditized so that EV infrastructure can cater to all consumers utilizing the technology and benefit from economies of scale. Introducing smart batteries with trackers can mitigate banks’ fears about loan defaults by allowing non-payment to be penalized by disconnecting the vehicle. Viewing the infrastructure from a different lens, battery charging stations could leverage surplus capacity in the Pakistani electricity grid to reduce national tariffs, potentially attracting greater interest from regulators and other stakeholders.

Conclusion

The future of EVs in Pakistan appears promising, with favorable conditions already in place. What the industry needs is a final push to propel it forward. By addressing financing and infrastructure challenges and fostering a supportive environment, Pakistan can capitalize on the immense potential of electric mobility.