The Outlook

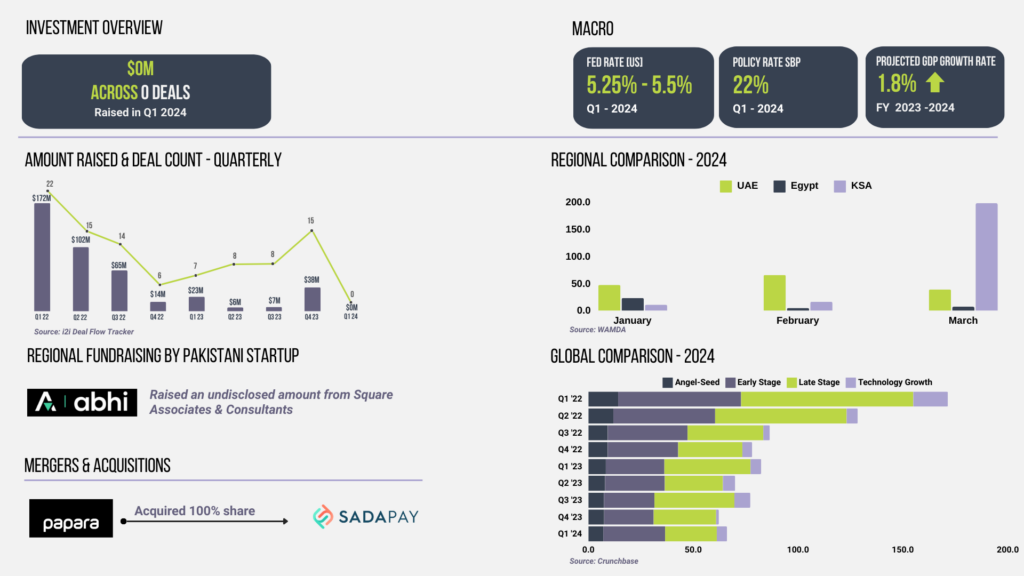

Frugality, often seen as a negative trait in business, remains essential for startups, especially in their early days. The current funding environment emphasizes this necessity for local startups. Q1 of 2024 has unsurprisingly resulted in zero fundraising, reflecting the ecosystem’s fears after 24 months of economic disarray.

Since tracking Pakistan’s funding flows in 2015, this is the first instance of no activity for an entire quarter. The groundwork for this development was laid well before its occurrence, due to economic instability and lack of political cohesion, which have dented investor confidence across asset classes in Pakistan. Additionally, the dicey global economic situation and the high-interest rate environment have dried up the venture funding pipeline.

Economic Concerns

The macros continue to be a significant concern. The World Bank projects Pakistan’s GDP growth to be a mere 1.8% in the current fiscal year, with aggregate demand remaining low and foreign exchange reserves under pressure due to external debt obligations. Nevertheless, some positive developments were observed during the quarter, including the completion of general elections and the transition of power from the caretaker setup to the elected government. Additionally, the country is progressing towards fulfilling the existing IMF stand-by agreement and transitioning to a newer long-term program.

In Q1, Pakistani startups raised $0 million across 0 publicly disclosed deals, a stark contrast to the approximately $1004.43 million raised across 353 deals since 2015. This marks the first time since we started covering funding rounds that no amount was raised in a quarter.

Around the World

Global Comparison

The global venture funding slowdown continues into 2024, with the first quarter recording the second-lowest activity since 2018. According to Crunchbase, global venture funding reached $66 billion in the first quarter, marking a 20% year-on-year decrease.

Regional Comparison

The MENA region leads the way in venture funding recovery, having raised $429 million in Q1 2024:

- Saudi Arabia: $224.7 million across 42 deals

- UAE: $151.2 million across 44 deals

- Egypt: $34.6 million across 17 deals

While the region continues to attract investors, the spike in funding has been driven by Saudi Arabia and the UAE, with other countries lagging in terms of recovery. Notably, Saudi startups raised around $198 million in March, partly due to the LEAP conference held in Riyadh.

Investor Activity

Investor confidence has been negatively impacted by the challenging economic conditions in the country over the past year. VCs and other investors remain cautious, including the potential for another round of rupee devaluation. Additionally, foreign investors are closely monitoring the FED’s policy rate decisions. The US central banking system kept interest rates at a record high in its latest policy meeting in March. A rate cut, if implemented in the coming months, could facilitate the recovery of the venture funding pipeline.

Mobilizing local funds also remains challenging, with the domestic policy rate at 22%, providing little incentive to shift liquidity from debt instruments to venture funding. The subdued investor activity is expected to persist throughout the year, with potential improvement in the second half if the macroeconomic situation stabilizes following a successful IMF program. Additionally, the lead time for disbursement of funding has extended due to more stringent due diligence by investors, which may result in increased investment announcements in the latter half of the year.

Mergers and Acquisitions

There was only one notable acquisition:

Fintech: Papara x Sadapay

Turkish fintech powerhouse Papara acquired SadaPay, a prominent fintech company in Pakistan. Although the details of the acquisition have yet to be revealed, reports indicate that the all-stock deal is valued between $30 million and $50 million.

Exploring New Avenues

While access to conventional equity and debt financing is limited, avenues for catalytic financing have expanded. Acumen Pakistan’s Climate Fund exemplifies this potential. The non-profit has secured $28 million anchor funding for a new $90 million Climate Fund targeting the agriculture sector in Pakistan. This initiative is structured as an innovative blended finance facility, with $80 million in equity funding allocated for early- and growth-stage local agribusinesses.

In addition to concessional financing, traditional routes can be accessed by expanding regionally. ABHI, a Pakistani fintech startup, recently closed a funding round in the MENA region, led by Square Associates Ventures, signaling local startups to consider regional expansion for securing additional financing.

See You in Q2!

While these are difficult times for the ecosystem, we remain optimistic for a turnaround. Having documented the Pakistani ecosystem for more than a decade, we have seen multiple down cycles, only for the ecosystem to bounce back stronger. Our optimism stems from informed estimates, not delusion.

Recent Developments

- In January 2024, VC funds on Carta had the highest amount of capital available for investment since mid-2022. Fund managers need to call this capital before it becomes accessible for investing in startups, serving as a staging area where the GPs prepare to allocate the funds to companies.

- Foreign investors are turning to local T-Bills through Special Convertible Rupee Accounts (SCRA) in Pakistan, taking advantage of high local interest rates and a stable Pak rupee. After a 4-year hiatus, there was a net inflow of $82 million into T-Bills from March 1-22, 2024, with total inflows reaching $126 million since January 2024. Political uncertainties and currency risks have historically deterred carry trades in Pakistan, but with the prospect of a new long-term IMF deal, there is potential for increased foreign investment in high-yielding government papers, providing short-term support to Pakistan’s forex reserves and the Rupee.

We hope you enjoyed this update and look forward to seeing you next time!