Introduction

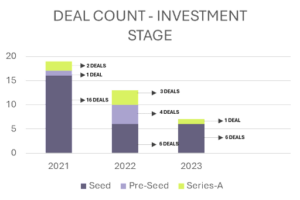

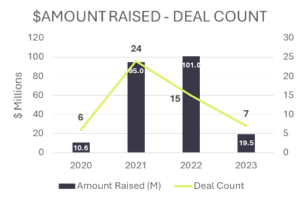

When it comes to encapsulating the ethos of Pakistan’s startup ecosystem, fintech stands out. Over the past two decades, players in this sector have made significant strides in developing and delivering innovative products. This vertical has consistently garnered investor interest, and in 2023, Pakistani fintech companies led in deal closures. Notably, fintech startup Abhi raised $6.8 million for a Sukuk bond in May 2023, marking a first for a fintech in the MENAP region. However, recent macroeconomic challenges have pushed many fintech startups to the brink.

A Bumpy 2023

Economic Contraction and Lending Challenges

A significant economic contraction eroded the spending power of the average Pakistani, driving demand for lending solutions. However, this demand was met with the rise of exploitative nano-lending apps, prompting regulatory authorities to take notice. Lending in Pakistan is challenging due to the absence of formal credit scoring systems and the high cost of funds, driven by a 22% policy rate. Fintech companies face a dilemma: pass costs on to customers or absorb them in anticipation of future rate decreases.

Promise at the Payments Front

Mobile Banking and E-Wallets

According to the State Bank of Pakistan’s (SBP) latest Payment Systems Review for Q4 2023, mobile banking emerged as the leading retail payment channel, with transactions reaching 279.9 million, an 80.2% year-on-year increase. E-wallet transactions also saw significant growth, reaching Rs 50.8 billion across 20.1 million transactions, reflecting a 37% and 30.5% increase, respectively. The pace of digitalization in the economy has accelerated, presenting significant opportunities for fintech companies.

Market Potential

The market is poised to expand further, given the relatively low levels of the banked population. As of June 2023, there were 83 million unique bank accounts in Pakistan, equivalent to 60% of the 137 million adult population. Notably, 29 million accounts were held by women, representing approximately 43% of the female adult population. The importance of merchant digitization is also evident, with POS payment throughput reaching Rs. 363 billion in Q4 2023. Legacy players like Jazzcash have enabled over 300,000 merchants to process QR/Till digital payments exceeding Rs.10 billion per month.

Navigating the Challenges

Innovative Solutions

Despite numerous challenges, innovation remains a driving force behind the growth of the fintech sector. For instance, Adalfi leverages AI and transactional data from banks and NBFCs to improve credit scoring and reduce loan default rates. Finja, Pakistan’s first and only P2P licensed startup, offers an alternative by connecting borrowers and investors directly, bypassing traditional banking channels.

Pioneering Developments

A pivotal moment arrived when ABHI, a provider of Earned Waged Access and Invoice Factoring solutions, issued the MENAP region’s first Sukuk for a fintech company. This Rs. 2 billion offering created a new avenue for local startups to secure additional capital amidst a funding shortage.

The Future Playbook

MSME Lending

As we analyze the current fintech landscape and underlying trends, MSME lending emerges as a recurring theme in the business plans of operators nationwide. The opportunity is significant, and many are eager to enter this market. Horizontal expansion appears to be a primary strategy, starting with services like payroll processing and bookkeeping/ledger apps, and subsequently expanding into payment processing and lending services.

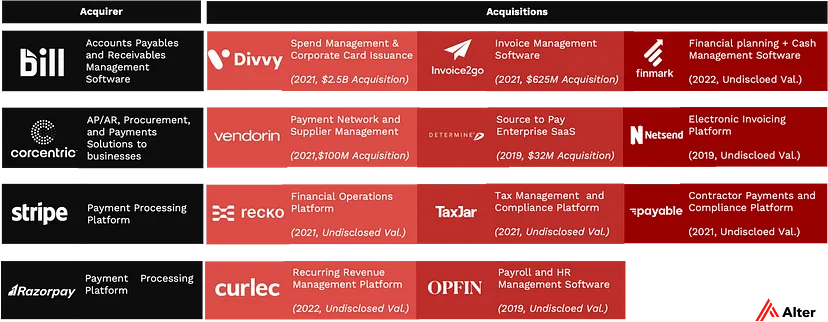

While the sector may seem congested with numerous players, eventual consolidation through mergers and acquisitions is likely to restore equilibrium.

Conclusion

The fintech sector in Pakistan, despite facing significant challenges, continues to innovate and adapt. With promising developments in mobile banking, e-wallets, and innovative solutions, the future of fintech in Pakistan remains optimistic. However, strategic expansion and consolidation will be key to navigating the current economic landscape and capitalizing on emerging opportunities.