What were the big trends in Pakistan’s startup space in 2018?

There is an endless list of things happening nationwide that will hopefully be positive for both founders and investors in 2019, and we plan to track these developments in future Insights issues. For now, we can comment on the trends we found exciting in 2018.

As noted by many industry experts, the rise in venture capital activity in Pakistan is a positive trend, particularly because 2018 showed considerable growth as compared to the year before. The 2017 KPMG Global Analysis of Venture Funding Report showed an investment of $23.1 million by venture capital firms in Pakistan. Comparatively, this year there were accounts of $343 million in investments in startups, which translated to a 1,384 % overall growth in investment on startups.

Yes, 1,384%. If that number sounds too good to be true, that’s because it is. Although there was a rise in investments in startups in 2018, this number is actually inflated when we look critically at the entities that raised funding. An article by Techjuice that claimed that Pakistani businesses raised over $300 million in funding is slightly misleading, given that not all the companies in the list are actually startups. While Techjuice did point this out (and the article has great data btw, so give it a read), that nuance was missed in all the retweets and reposting of the piece. In this Medium piece, Zubair Naeem Paracha breaks down what’s wrong with the article’s assertions, emphasizing that not all the entities are startups, and also that the aggregate number wasn’t purely investments, but also included grants. These are all valid points. For example, though Telenor Microfinance Bank received $184.5 million in investment from Ant Financial, the entity is a subsidiary of Norwegian corporate Telenor Group, which is most certainly not a startup. Excel Lab, which reportedly raised $31 million, has been operational for 25 years according to their website. The point is not to be dismissive of the progress made in the past year, but we should also not inflate these numbers. According to Paracha, if we remove the non-startup companies from consideration, Pakistani startups actually raised approximately $30 million in investments in 2018, which signifies a 30% growth rate, as opposed to a 1,384% rate.

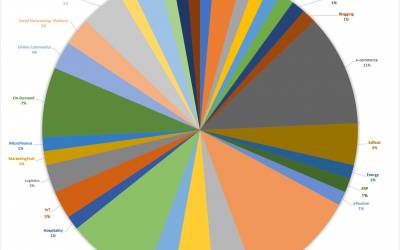

Figure 1: Frequency distribution of Pakistani startups in 2018 by sector

Four sectors that show an increased inclination are e-commerce, on-demand, fashion, and EdTech. Some sectors may seem more crowded because there are more startups that can be classified under those sectors but what also counts is how much funding these startups are getting. Some sectors may be prone to raise more in funding versus others such as Fashion versus HealthTech. While there may be more startups in Fashion they may not raise as much funding as those under HealthTech.

Disclaimer: This graphic is based on data available online through news portals such as techjuice, propakistani etc. Datapoints that have previously faced scrutiny for being erroneous were removed. These included entities such as Telenor Bank, Cloudcade, Excel Labs, etc.

Total number of startups used for this chart = 70*

*3 WEC (Karandaaz) startups were excluded from the chart since no or very little information about their product/service was available to determine the sector they may fall under. Total number of Pakistani Startups that raised funding in 2018 = 73

Talking Trends

As players in Pakistan’s startup ecosystem, we’re close to the ground and deeply aware of the challenges and opportunities that exist in the country. Here are some of the trends we’ve found to be significant of late:

- The early stage capital gap is still very real. In a past Insights newsletter (see here), we highlighted the early-stage gap by showcasing that the number of seed-stage deals dropped from 2015 to 2018, and there were only a handful of reported pre-Series A or Series A deals. The landscape is currently changing with new investors entering the market via institutional funds like Sarmayacar and i2i Ventures, which could ideally close this gap, and there are also a number of new local angel investors entering the ecosystem, many of whom are members of local family offices – which can be a good and bad thing in our opinion. As Sameer Chishty, Venture Partner at Spark Labs noted, “Prospective new tech investors are better off investing in Pakistan focused venture funds that know what they’re doing instead of trying to do it themselves; this space is crowded with “vulture” capital and “cocktail party” capital who are holding back growth.” Spark Labs, by the way, has indicated that their fund plans to set up an office in Pakistan this year, and aims to make two investments in the country in the first half of 2019. While these new institutional players are working to close the early stage gap, it’s important for players to keep in mind the need (and cost!) for additional technical assistance to their investees in order to ready them for follow-on rounds, and for funds to be prepared to ideally invest in those rounds. Many startups in Pakistan may be able to raise seed funding, but stumble when it comes to showing the traction & growth necessary for Series A and later rounds. Good and strategic investors can and should play a role in this, and that goes way beyond just injecting money into a startup and hoping for the best.

- The role of the Pakistan government in the startup ecosystem has grown, but challenges still remain. Ignite, which is under Pakistan’s Ministry of IT, is responsible for the launch of the National Incubation Centres (NICs) in the country’s major cities over the last few years – Islamabad, Lahore, Peshawar, Karachi & Quetta. While the results of these public-private NICs have not yet been evaluated (we’re talking outcomes, not mere outputs), the initiative by the IT Ministry and Ignite at least signaled buy-in from the federal government in Pakistan’s startup ecosystem. While this is significant, there is still much more that can and should be done by the Pakistani government when it comes to the business enabling environment. The current regulations in Pakistan continue to be debilitating for startups and investors alike, particularly as it relates to taxation, the flow of money in and out of Pakistan, overall regulations around payments, and the current legislation around local fund registration. While the proliferation in activity in Pakistan’s startup space is exciting, this activity will always be capped because of this poor regulatory environment. Here’s hoping that the current PM Task Force in the new government (with representatives from the country’s IT sector), address some of these longstanding concerns.

- The pipeline may still be too small for funds to really be sector-specific, but there are some exciting sectors. While several funds are “technology-enabled but sector-agnostic” (including ours at i2i Ventures), there are still some sectors that are exciting at the moment (see Figure 1, and below, Figure 2 for past deals). The below image indicates investment in the past year e-commerce, Healthtech, Edtech, Fintech & on-demand startups. Going into 2019, sectors that excite our team at i2i Ventures are startups in the gig economy-based provision of services (think startups like Mauqa.Online and GharPar), as well as education technology plays like Dot & Line. While i2i Ventures’ Investment Manager Asad Jafri noted that B2G (business to government) models where the government is involved is less exciting, our Managing Partner Misbah Naqvi noted that companies that instead plug the gap where government has failed can be the most interesting. “Sometimes the simplest solutions can go the furthest in terms of scale and plugging the gaps,” she added.

| Sector-wise breakdown of amount of investment raised by Pakistani startups in 2018 |

This analysis excludes HAC Agri from the AgriTech category since their investment amount remains undisclosed. Similarly, WEC startups (funded by Karandaaz) were also excluded because their total funding amount is not disaggregated for each startup, which makes it impossible to determine how much each startup received.

Evidently, WaterTech sector has drawn the largest amounts of funding with only 2 startups, but this is because PakVitae makes up most of this amount.

Obviously, there’s much to unpack here, but one thing is for certain: we are hopeful about the future of Pakistan’s startup ecosystem. Many thanks to Sameer Chishty, Asad Jafri & Misbah Naqvi (and our CEO Kalsoom!) for letting us prod you with questions for this issue. If you’d like to chat more or get more information on any of mentioned data or trends, feel free to get in touch at ambareen[at]invest2innovate[dot]com.

Cheers,

Ambareen Baig

Insights Lead

Invest2Innovate

Pingback: bonanza 178

Pingback: bonanza178

Pingback: sahabat kartu

Pingback: Texas gun trader

Pingback: นำเข้าสินค้าจากจีน

Pingback: mushrooms yayoi kusama

Pingback: click for more

Pingback: บทความ บุหรีไฟฟ้า relx

Pingback: buy marlin guns

Pingback: situs toto

Pingback: bonanza178

Pingback: Charter firearms

Pingback: บุหรี่นอกเก็บเงินปลายทาง

Pingback: slot online

Pingback: snuscore

Pingback: slot88

Pingback: ป้ายโฆษณา

Pingback: choi game

Pingback: DataSGP

Pingback: ไลค์แฟนเพจ

Pingback: aksara178

Pingback: go to this web-site

Pingback: Toyota 2023 ราคา

Pingback: muha meds carts

Pingback: เช่าเรือสปีดโบ๊ท,เช่าสปีดโบ๊ท เจ้าพระยา,เรือเช่าเหมาลํา เจ้าพระยา

Pingback: สล็อต ฝากถอน true wallet เว็บตรง 888pg

Pingback: Duurzaam Spelen

Pingback: tadalafil lozenge

Pingback: best website for essays

Pingback: best college application essay service

Pingback: academic essay writing service

Pingback: buy essay paper

Pingback: essay writing service discount code

Pingback: essay writing services toronto

Pingback: pay to write my essay

Pingback: top essay writing websites

Pingback: the best essay writer

Pingback: custom essays service

Pingback: help in writing essays

Pingback: professional custom essays

Pingback: original essay writing service

Pingback: online essay helper

Pingback: essay help online chat

Pingback: can you buy viagra at the pharmacy

Pingback: rx pharmacy symbol

Pingback: united rx pharmacy

Pingback: pharmacy review xanax

Pingback: mexican pharmacy weight loss

Pingback: how fast does cialis work

Pingback: genuine viagra australia

Pingback: when does the cialis patent expire

Pingback: cialis canada over the counter

Pingback: viagra 100mg cost in india

Pingback: tadalafil 20 mg soft tabs

Pingback: viagra over the counter nz

Pingback: best online pharmacy uk viagra

Pingback: sildenafil tablets from india 100mg tablets

Pingback: where to buy generic viagra in usa

Pingback: cialis doesnt work for me

Pingback: cialis and poppers

Pingback: cialis daily

Pingback: hydrocodone mexico pharmacy

Pingback: buy sildenafil 20 mg without prescription

Pingback: cialis contraindications

Pingback: generic tadalafil price

Pingback: generic viagra online purchase

Pingback: cialis online with no prescription

Pingback: provigil online pharmacy reviews

Pingback: generic viagra in the usa

Pingback: cheap viagra online canadian pharmacy

Pingback: sildenafil 2 mg cost

Pingback: brand viagra for sale

Pingback: otc sildenafil 20 mg tablets

Pingback: lowest price for generic viagra

Pingback: cialis generic prices

Pingback: cheapest cialis india

Pingback: cialis 10 mg

Pingback: buy brand cialis

Pingback: flagyl antabuse

Pingback: bactrim 14

Pingback: gabapentin paranoia

Pingback: valtrex 400mg

Pingback: nolvadex depression

Pingback: pregabalin 75 mg lyrica

Pingback: lisinopril lotrel

Pingback: lasix bloedtransfusie

Pingback: glucophage conception

Pingback: goodrx rybelsus

Pingback: rybelsus drug class

Pingback: zoo in rybelsus commercial

Pingback: gabapentin testimonials

Pingback: metronidazole desensitization

Pingback: zoloft libido

Pingback: cymbalta making me sleepy

Pingback: effexor vs lexapro

Pingback: escitalopram en español

Pingback: uk viagra no prescription

Pingback: fluoxetine antidote

Pingback: keflex tabletas para que sirve

Pingback: what medication is similar to duloxetine

Pingback: is cephalexin 500 mg a strong antibiotic?

Pingback: what bacteria is resistant to ciprofloxacin and levofloxacin

Pingback: bactrim dosing for uti

Pingback: bactrim ds dose

Pingback: amoxicillin and clavulanate potassium side effects

Pingback: mp flomax 15

Pingback: diltiazem drug class

Pingback: augmentin diarrhea

Pingback: citalopram hbr 20mg side effects

Pingback: in brief ezetimibe simvastatin vytorin in chronic kidney disease

Pingback: can i take ibuprofen with flexeril

Pingback: diclofenac sodium 75 mg tablet

Pingback: cozaar 50mg

Pingback: is 450 mg of effexor too much

Pingback: ddavp dose intranasal

Pingback: depakote drug

Pingback: contravention classe 5 violence volontaire

Pingback: amitriptyline 10mg

Pingback: when to take allopurinol

Pingback: aspirin overdose symptoms

Pingback: aripiprazole used for

Pingback: baclofen pump surgery

Pingback: celecoxib contraindication

Pingback: how long does it take ashwagandha to work

Pingback: what are the side effects of celebrex

Pingback: augmentin price

Pingback: abilify ruined my life

Pingback: remeron for elderly

Pingback: pentasa lactose

Pingback: co-repaglinide side effects

Pingback: another name for robaxin

Pingback: acarbose alpha-amylase

Pingback: protonix for acid reflux

Pingback: switching from semaglutide to tirzepatide

Pingback: what is tizanidine 4mg tablets used for

Pingback: stromectol price in india

Pingback: is voltaren a blood thinner

Pingback: tamsulosin esparma 0.4 mg nebenwirkungen

Pingback: 3 months on spironolactone

Pingback: venlafaxine drug interactions

Pingback: synthroid tolerance

Pingback: sitagliptin metformin 50/850

Pingback: how long does 20mg sildenafil last

Pingback: viagra from pharmacy

Pingback: buying generic levitra online

Pingback: sildenafil for premature ejaculation reviews

Pingback: cialis online pills

Pingback: why is levitra so expensive

Pingback: tadalafil 10mg online

Pingback: clotrimazole price pharmacy

Pingback: viagra in mexico over the counter

Pingback: stromectol tab price

Pingback: ivermectin 18mg

Pingback: tadalafil is not for consumption in united states

Pingback: ivermectin 3mg pill

Pingback: stromectol xr

Pingback: tadalafil ebay

Pingback: levitra vardenafil hcl tablets

Pingback: ivermectin 1 topical cream

Pingback: generic ivermectin for humans

Pingback: viagra substitutes

Pingback: vardenafil troche

Pingback: how long does metformin take to work

Pingback: what should i avoid while taking valacyclovir?

Pingback: what pain reliever can i take with lisinopril

Pingback: ampicillin sulbactam oral india

Pingback: gabapentin

Pingback: maximum dosage of provigil

Pingback: how long does augmentin stay in your system

Pingback: metronidazole for bv

Pingback: how long does cephalexin take to work for uti

Pingback: keflex dose for cellulitis duration

Pingback: how long after taking prednisone can you drink alcohol

Pingback: how long does ciprofloxacin stay in your system

Pingback: how long should you take lyrica for nerve pain

Pingback: can i take doxycycline with food

Pingback: amoxicillin brand name

Pingback: wellbutrin and trazodone

Pingback: nolvadex dosage for pct