How much investment activity has there actually been in Pakistan’s startup space?

(Note: The numbers stated in this newsletter are based on data i2i mined via publicly reported deals. Therefore, there may be some gaps in the data. Please feel free to send us additional information you may have so that we can make sure all future analysis is as complete as possible.)

Hello friends, colleagues and co-conspirators!

The investment landscape in Pakistan is tough. Access to funding is always among the top 3 reasons for startup failure and/or inability to scale. A survey of the ecosystem for our Pakistan Entrepreneurship Ecosystem Report 2016 indicated that 84% of entrepreneurs considered raising investment as difficult or somewhat difficult. The stakeholders we’ve interviewed for this and previous newsletters have further echoed this sentiment. One of the primary problems is the small number of venture capital players in the ecosystem, which result in a small number of investment deals.

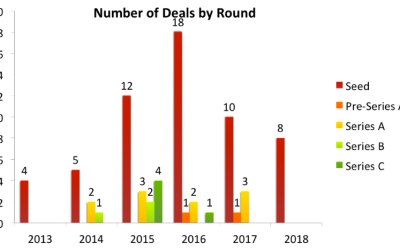

In Pakistan, some of the first players to dive into the early stage investment landscape were angel investors. Most of these investors operated informally, and invested with their friends in entrepreneurs they already knew. Over the past five to six years, groups of angel investors did become more formal funds (for example, Dotzero Ventures and CresVentures), and more venture capital players did enter the market. Interestingly, the rise of players has not translated in more capital being deployed within the ecosystem over time. Investment activity in Pakistan peaked in 2015 with a total of 27 deals and has since been declining with the number of deals in 2017 falling by 43% compared to the previous year. However, it’s not just the number of the deals but also the total value being invested in the country that has gone decreased over the past three years. In 2015, the total value of reported investments made within the ecosystem amounted to $155.35 million. However, since then this amount has decreased to $28.58, $4.32 & $4.80 million respectively each subsequent year. While the figures for 2018 have already surpassed the 2017 numbers, the decline between 2016 & 2017 is significant. Even if we were to eliminate some of the bigger investment rounds from consideration, such as Zameen, Daraz, Naseeb Networks & Careem deals, the year-to-year differences remain noteworthy. A closer inspection of the data also demonstrates that the number of deals being made at the post-seed stage have also been declining since 2015. This has contributed to a major gap that exists when it comes to follow-on funding.

In the graph titled “Investment in Millions of USD,” some of the bigger deals have been excluded for the sake of ensuring that the scale remains readable (deals $9 million & above were excluded which impacted the numbers for 2015 & 2016 only. The total for those years is noted in the body of this newsletter). The numbers in the graph titled Number of Deals reflect all recorded deals.

As stated previously, this data is based on deals that are recorded and reported and there may be some deals missing from our analysis. However, while a key takeaway may be that overall investment activity is slowing down, the data also doesn’t cover other forms of funding – i.e., grants. In the past few years, an increasing amount of Development Finance Institutions (DFIs) like DFID and USAID have made entrepreneurship a priority in their mandate, and many startups, in the absence of quality investors, will raise funding via DFI grants or even via local or global competitions and challenges. For example, Jaan Pakistan, a startup that provides clean cookstoves to off-grid communities in the country, recently won $100,000 as a grant from Dubai’s Expo2020. Ultimately, in a nascent investor ecosystem like Pakistan, founders will be creative in raising funding, and there are an increasing number of institutions that provide grants and support.

Have more to say on the topic? Or just share some interesting research/articles with us? Give us a shout!

Cheers,

Anusheh Naveed Ashraf

Head of Insights, Invest2Innovate