Customer research and validation are critical to growth but are we doing it right?

Hello friends, colleagues and co-conspirators!

During an investor panel at 021Disrupt earlier this month Fares Ghandour, Partner at Wamda Capital gave some advice to Pakistani entrepreneurs that I believe was particularly pertinent: “Make your investors look dumb.” In other words, an entrepreneur should know their business and market better than anyone else. At the face of it, this doesn’t sound like rocket science, but in our six years of working with startups in Pakistan one of the biggest problems we’ve witnessed is a lack of understanding of a startup’s customer base and market. While globally billions of dollars are spent on market research, in Pakistan I’ve seen the opposite being true. Very rarely do startups or businesses budget for research and when they do their approach tends to lean towards more traditional metrics.

While these metrics may give you the basic information & numbers, you will glean no real insight on behavior, aspirations, or perceptions of your customers. In our last issue on why startups fail we talked about CB Insights’ research on startup failure and among the 20 reasons listed, four can be directly linked to bad or inadequate research and/or understanding of a customer base; e.g. failure to pivot, ignoring customers, no market need and poor product. Without deep customer insights, companies end up creating solutions and experiences that are just not important enough from the customer perspective.

Part of the problem lies in the fact that such research is often considered costly and time intensive, and companies assume they need a statistically significant dataset to get any insights. However, I strongly believe that a smaller sample size can still be extremely valuable. While you might not be able to run regression analysis on these responses, if done right they will often lead to deeper understanding of your customer personas with far more powerful touchpoints about everyday lives, behavior, pinpoints of your customers and insight into what problems they want solved. This information is in my opinion the real make or break for any business and the need for it can be addressed by creating simple and continuous feedback loops: build, measure, learn – ring a bell? The Lean Startup methodology focuses on this approach at its core, where you’re having meaningful conversations with people about the product/service and the impact it’s creating.

One of the major success stories of a company that has leveraged customer insights is coffee chain Starbucks. The company realized that customers had to wait too long for their orders particularly during peak hours/seasons. This insight led to the addition of the mobile ordering and payment option within their app, which meant that customers could pre-order on their way to the store and avoid long wait times. Not only did this result in greater customer satisfaction but the company’s revenue reportedly grew by 11% as a direct result (speaking of coffee, want coffee culture and consumer insights in Pakistan? We share the results from market research we carried out last year in the next section).

By knowing as much as you can about your target audience, you can better deliver value and tailor your product/service accordingly. This can only happen when you’re asking key questions like, Who are your customers? What are their goals? What goals define their behavior? Why do they need your product? What are their hesitations with your product? What is most valuable to them about your product? The traditional way data and analytics have been used so far give a great picture of how a product or service did, e.g. # of downloads, active users/subscribers, sales etc, but they offer no information on WHY customers chose your product over another, what influences them and what discourages them from using it. At i2i, we always encourage our entrepreneurs in our accelerator program to develop deeper customer personas that get at the WHY behind any decision purchase. Simon Sinek sums it up perfectly in his wildly popular TEDTalk on how great leaders inspire action, “People don’t buy what you do, people buy why you do it.”

If you’re a startup thinking about scaling-up, my advice to you is to take the next month to talk to at least 50 of your customers and testing out some of the assumptions you’ve made around their personas and behaviours. Customer validation is the critical first step before you grow.

Read on for more on customer insights & research. In the next section we share the methodology & results from a project we did to glean consumer insights from the coffee drinking population in Pakistan. Have more to say on the topic? Or just share some interesting research/articles with us? Give us a shout!

Cheers,

Anusheh Naveed Ashraf

Head of Insights, Invest2Innovate

Last year we were engaged as consultants by a local artisanal coffee company in Pakistan (their coffee is all locally roasted) to help with their branding and marketing strategy. While Pakistan is widely known as a chai-drinking nation, according to a Euromonitor report coffee consumption is on the rise. In 2016, Nestle led the coffee sales with a retail value share of 50% (Although it’s interesting to note that in 2015, Nestle said this figure was at 73%). The limited number of fresh coffee players, lack of awareness about good and fresh coffee and rising consumption all present an opportunity for new brands to expand sales in the sector. In order to help our client in this mission, i2i used three different tools (online surveys, focus groups and B2B interviews with retailers, cafe and supermarket owners) and reached out to a total of 300 people to distill insights about coffee habits in the country. The online survey received a total of 236 responses, out of which 161 were complete.

- Demographic breakdown: Of the majority of respondents, 72%, were young and fell in the 18 to 30 years age bracket and only 25% were 31 to 50 years old. Out of the complete responses, 45.7% were by females and 54.2% were male. Most respondents were also based in major cities e.g. Lahore, Islamabad Rawalpindi and Karachi.

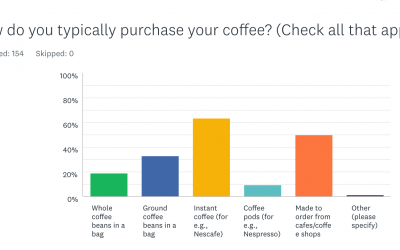

- Coffee drinking habits: Much of the survey validated the commonly held assumptions about coffee culture in the country e.g. 69.5% of respondents drank Nescafe instant coffee. Among fresh coffee drinkers Nespresso (coffee pods) and Lavazza are the most popular. 40% of coffee consumers drink at home, followed by 29% who drink made-to-order from coffee shops and 28% who drink it in the office. In addition while making a coffee purchase, the following factors were the most important in order or priority:

-

- Availability,

- Ease of making coffee and

- Aroma & Taste.

- Lifestyle: We found an interesting correlation between age and having a more sophisticated coffee palate. Younger respondents skew towards instant coffee or coffee shops (made-to-order), while older consumers (31 to 50) were relatively more sophisticated and educated in their choice of coffee and tended to lean towards fresh coffee. However, during the focus group discussions these older respondents did note that they drank Nescafe when they were younger. For most people, coffee is very experience-based. Unsophisticated coffee drinkers mainly consume coffee in social settings with friends at coffee shops. Both kinds of coffee consumers linked coffee to “down-time”, “me-time”, and “rituals”, however, sophisticated consumers are very attached to their coffee rituals despite being representative of a much smaller population.

Based of all the data collected here are some insights that i2i was able to draw:

- Coffee is an ‘aspirational’ product – the younger/unsophisticated consumers can grow into potential fresh coffee consumers because ‘fancy’ coffee is linked to upward mobility and perceived affluence. The typical customer persona for fresh coffee is 30+ years olds, middle-high income Pakistanis or expats.

- People don’t know enough about coffee, which translates to an opportunity to build awareness around what “good” and “quality” coffee means. Perhaps newer players need to concentrate their Brand Activation efforts on providing an amazing coffee experience.

- Packaging (all the key info usage, size, flavour profile displayed upfront) and brand story have a strong impact on consumer buying decisions. Much more so than taste & quality, especially when talking to unsophisticated consumers.

- Word-of-Mouth is the key marketing technique when it comes to coffee purchasing. People need to hear and see a brand more often for this connection to convert into sales. Therefore, touch points, brand ambassadors and loyalty programs can make an immense difference.

- Presence at office canteens and cafes are the best way of converting people into coffee drinkers and/or your brand. These locations provide the perfect combination of social-setting, access and ‘vibe’ for coffee consumption and also allow for more one-on-one interaction with the brand.

Jawwad Farid, Founder Finance Training Course recently put together some data on Pakistan’s Risk Rating. The country has historically been overlooked due to the opaque political and regulatory environment and an overall lack of easily accessible and open data but this piece makes the case for the opportunity in Pakistan. “The opportunity can be summarized very simply. A US$ 400 billion nation state sized economy will be reshaped by technology in the next 5 – 7 years. The old guard will lose market share, customers and mind share. Technology backed ideas will play a major role in this re-slicing of the economic pie. You can watch from the sidelines or participate and play a role in this great re-slicing exercise.” You can find the full piece and both infographics here.

Pingback: Acheter Subutex sans ordonnance

Pingback: เศษผ้าขาว

Pingback: รับเดินบัญชี

Pingback: raja bandarq

Pingback: aksara178

Pingback: Magic Mushroom Australia

Pingback: PG

Pingback: yehyehคาสิโน

Pingback: รับทำ SEO

Pingback: ป้ายโฆษณา

Pingback: w88 ทางเข้า

Pingback: alpha88 thailand

Pingback: ดูบอลไทยลีก

Pingback: alpha88 เข้า ไม่ได้

Pingback: togel idn

Pingback: slot88

Pingback: สล็อต ฝากถอน true wallet เว็บตรง 888pg

Pingback: nicotine pouches

Pingback: slot88

Pingback: togel hk

Pingback: 20135 Homes for Sale

Pingback: เว็บคาสิโนออนไลน์

Pingback: best microdose mushroom

Pingback: vistarchitects

Pingback: SAGAME

Pingback: เพิ่มฟอลโล่

Pingback: result HK

Pingback: เว็บจ่ายจริง LSM99 ปลอดภัย ไม่มีโกง

Pingback: massage Bangko