Introduction: Understanding Gender Lens Dynamics in Startup Investment

Pakistan’s startup landscape is evolving, but gender disparities remain a critical issue. Applying a gender lens to this analysis, we examine how female-founded and co-founded startups are navigating the investment ecosystem. This insight highlights the progress and ongoing challenges in bridging the gender funding gap.

Defining Female-Founded and Co-Founded Startups in the Investment Landscape

- Female-founded startups: Startups with one or more female founders.

- Female co-founded startups: Mixed-gender teams with at least one female founder.

Gender Dynamics in Pakistan’s Startup Funding

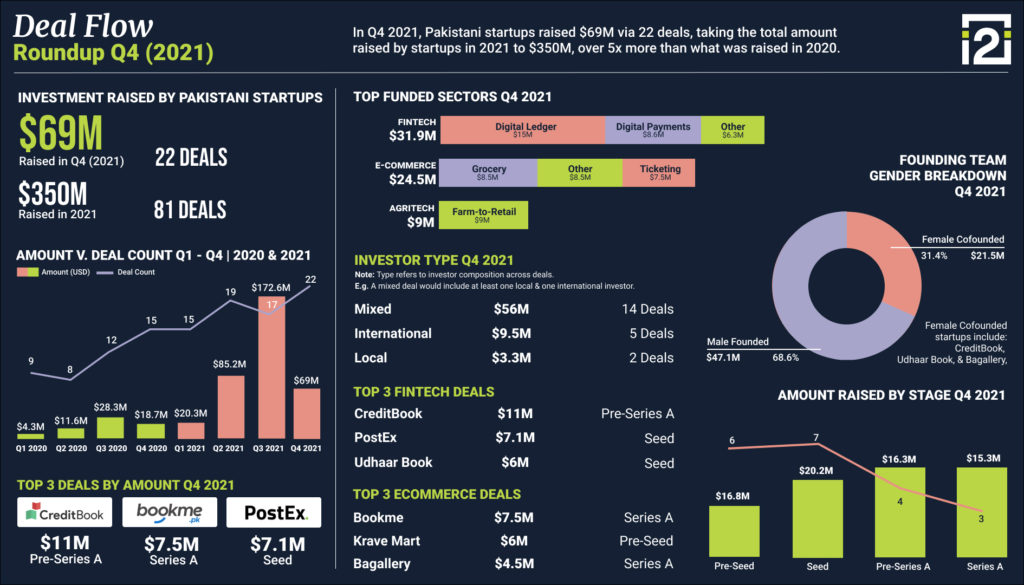

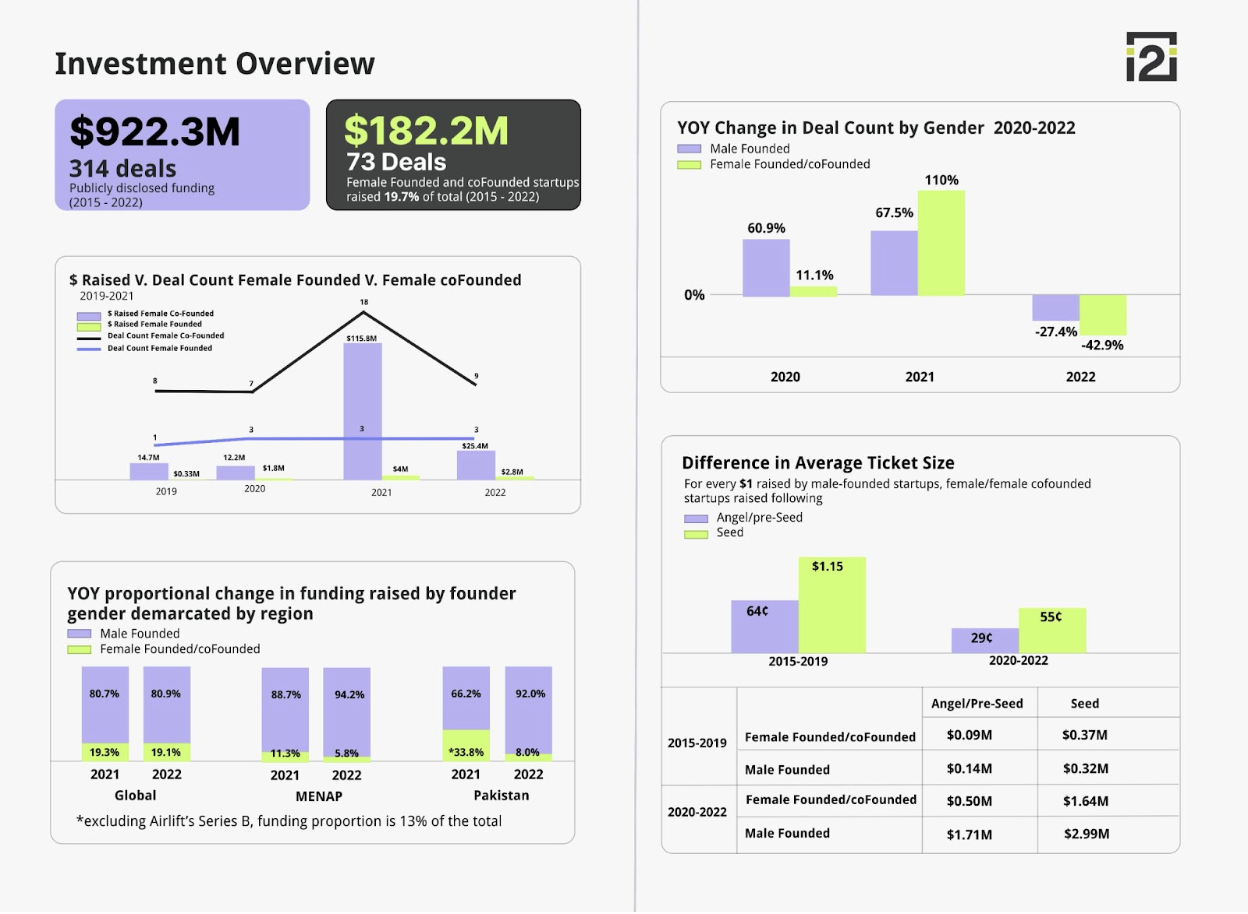

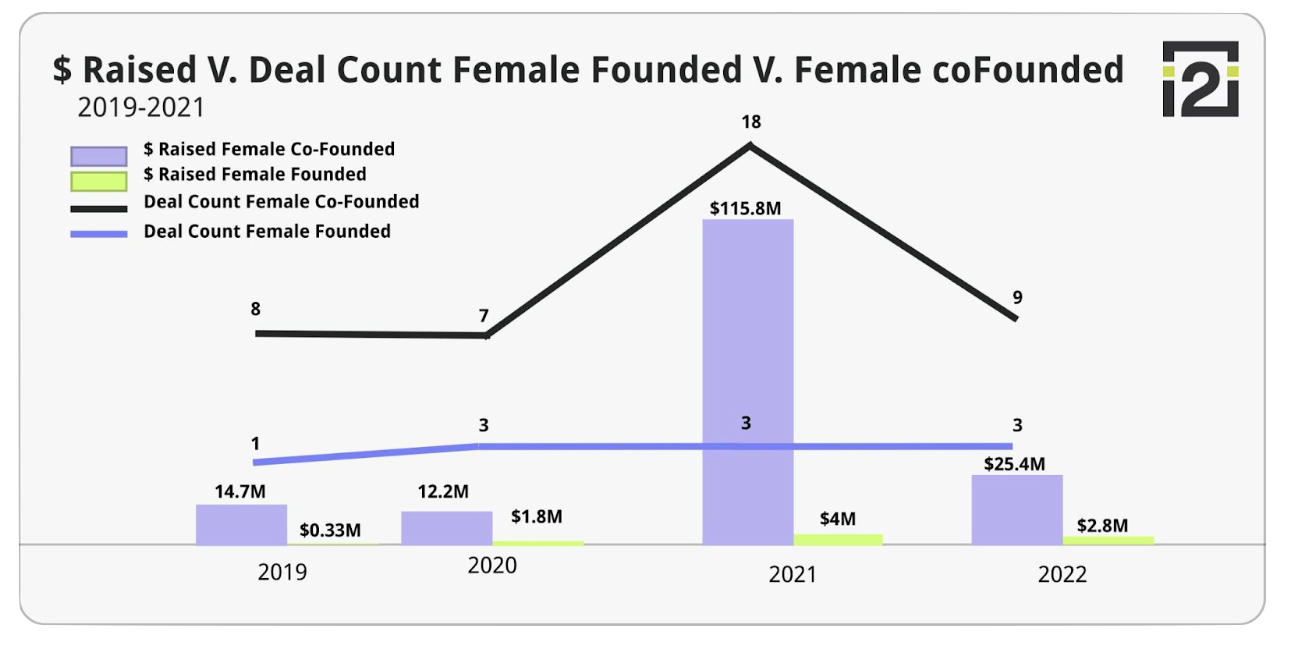

In 2021, female-founded and co-founded startups secured 34% of total startup funding in Pakistan, reflecting progress in bridging the gender funding gap. However, in 2022, this share dropped to 8% in Pakistan and under 6% in the MENAP region. Globally, female-founded startups raised only 19% of the total funding. This trend highlights ongoing gender disparities in investment distribution.

Deal Count Analysis: A Gender Breakdown (2015-2022)

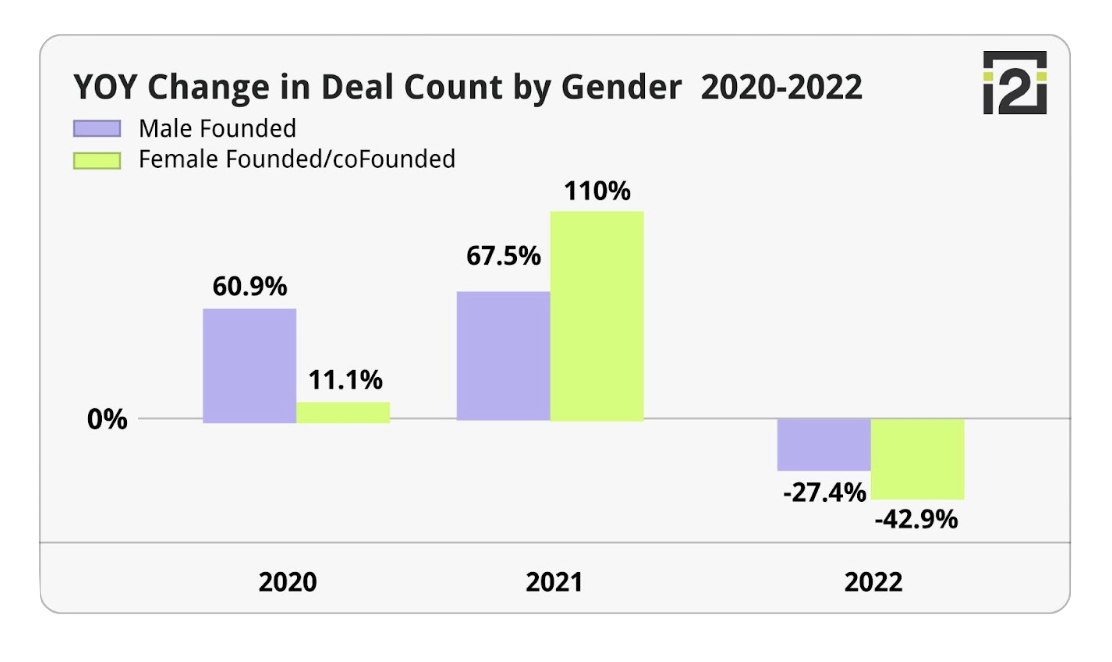

Between 2015 and 2022, female-founded and co-founded startups collectively raised about 20% of disclosed funding. Female-founded startups consistently closed around three deals per year, while female co-founded startups saw deal numbers rise from 7 in 2020 to 18 in 2021. The overall funding decline in 2022 impacted female co-founded companies more severely, with a 43% drop in deals compared to a 27% drop for male-founded startups.

Addressing Gender Biases

The data highlights biases in the startup ecosystem that favor male-founded startups. Female-only founding teams face additional hurdles, which may contribute to the lower funding shares and smaller ticket sizes observed.

Funding Discrepancies: Average Ticket Size by Gender

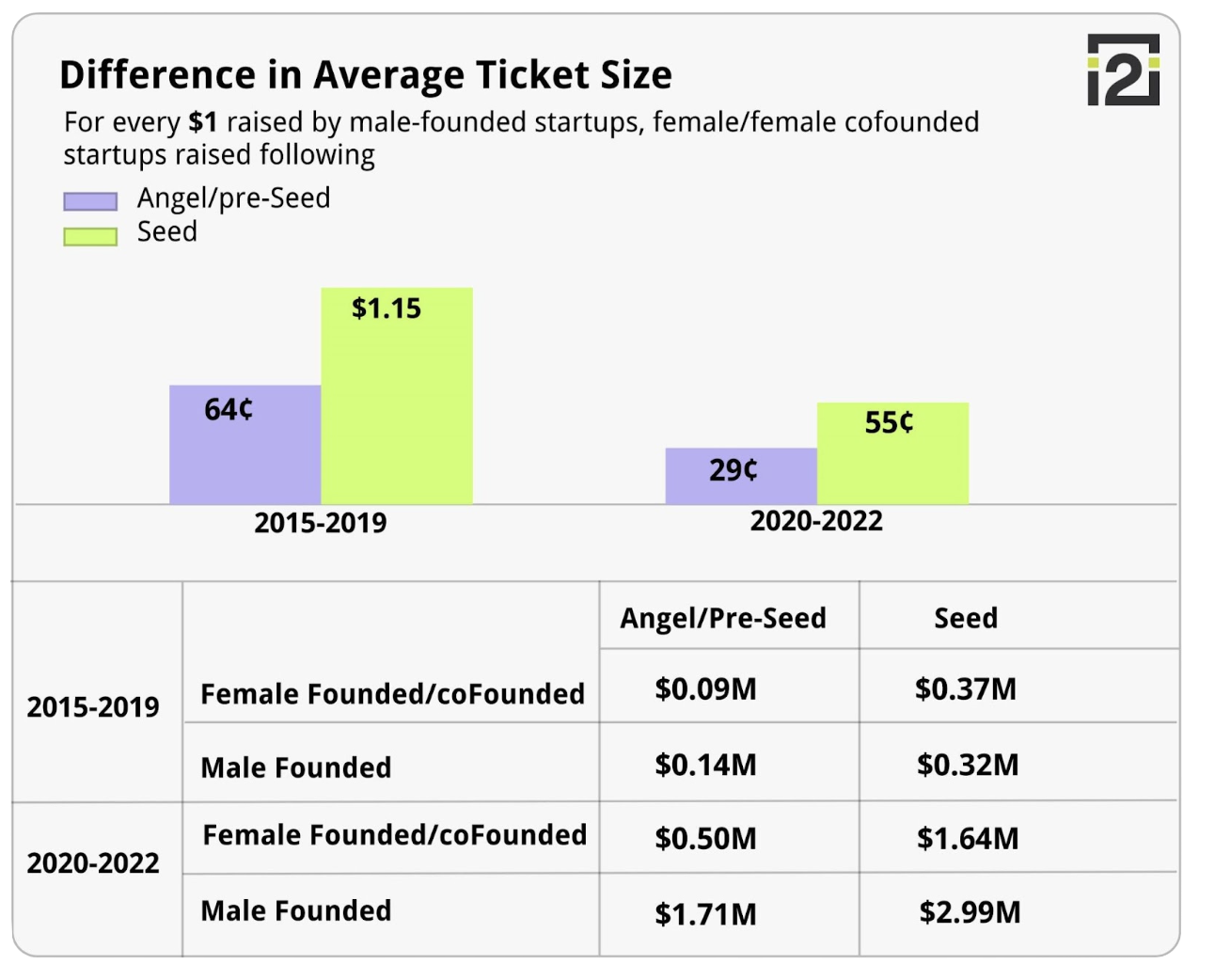

From 2020 to 2022, female-founded and co-founded startups raised significantly less capital than male-founded startups. For every dollar invested in male-founded startups, female-founded/co-founded startups raised only 29 cents in angel/pre-seed rounds and 55 cents in seed rounds. This reflects a stark funding gap that persists across all stages of investment.

Sector Comparison: Where Female-Founded Startups Stand

Top-funded sectors for both male and female-founded startups include e-commerce and fintech. However, female-founded startups often set lower valuations, leading to smaller funding amounts. This raises questions about whether female founders are undervaluing their businesses or if male founders are rewarded for higher, perhaps inflated, valuations.

Key Questions on Gender and Valuations

- Are female-founded startups more conservative in setting valuations?

- Are male founders rewarded for setting higher valuations?

- How do gender dynamics influence funding asks?

WeRaise Summit: A Collaborative Approach to Bridging the Gender Gap

Initiatives like the WeRaise Summit, hosted by the World Bank and Women Entrepreneurs Finance Initiative (We-Fi), are critical in addressing the gender funding gap. The summit, implemented by local partners like Invest2Innovate, efino, and Spring Activator, brought together diverse stakeholders to discuss solutions. Through focused networking sessions, participants explored ways to increase funding transparency and diversify funding sources for female entrepreneurs.

Conclusion: Moving Toward an Inclusive Startup Ecosystem

Addressing the gender funding gap requires a collective effort from investors, founders, and ecosystem stakeholders. By recognizing biases and supporting female founders, Pakistan’s startup ecosystem can move towards more equitable growth.

Learn More: Visit our Startup Deal Flow Tracker to explore detailed insights on gender-based investment trends.