Understanding Financial Inclusion

If you’ve been following Pakistan’s economic discussions, you’ve likely encountered the term “Financial Inclusion.” So, what does it mean? Financial inclusion refers to ensuring that everyone, regardless of their location, can access essential financial services like bank accounts, savings, loans, and insurance. It’s about enabling everyone to utilize the formal financial system to manage their finances, save for the future, and enhance their financial health.

This term is frequently mentioned due to the disparity between discussions and actual progress in accessing financial services. Various sources provide differing accounts of the current status.

The Current Landscape

The World Bank’s Findex report for 2021 indicated that 21% of the adult population in Pakistan was financially included. The Karandaaz Financial Inclusion Survey (K-FIS) reported an increase to 30% in 2022. Recent statements from the State Bank of Pakistan (SBP) suggest that as of June 2023, there were approximately 177 million bank accounts in Pakistan, with 83 million unique accounts, representing 60% of the 137 million adult population.

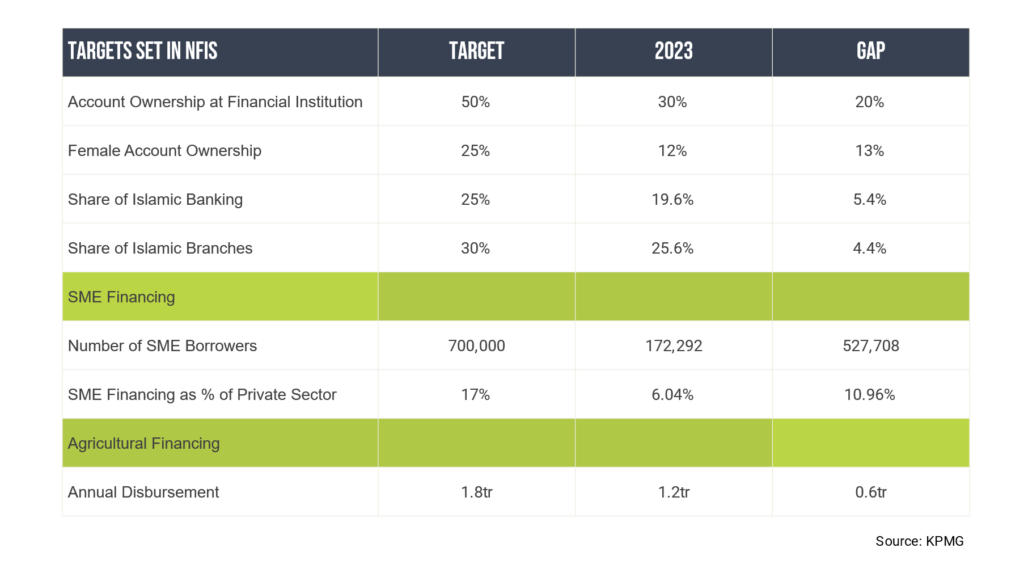

The State Bank of Pakistan (SBP) has been pivotal in driving financial inclusion through the National Financial Inclusion Strategy (NFIS) launched in 2015 and the Banking on Equality Policy introduced in 2021 to boost women’s financial inclusion. Additionally, the Digital Onboarding Framework in 2022 streamlined digital account opening processes, and the establishment of the first five Digital Banks in Pakistan.

But here’s the thing – the regulator is falling behind its targets.

While this topic could fill a series of blogs, our attention right now is on a specific issue that is very close to our heart – the financial inclusion of women.

The Gender Gap in Financial Inclusion

While there are many facets to financial inclusion, a critical focus is the financial inclusion of women. The data reveals a stark gender gap:

- Global Ranking: Pakistan ranks 142nd out of 146 economies in the Global Gender Gap Index 2023.

- Workforce Participation: Only 24% of the workforce in Pakistan are women, compared to around 33% in India.

- Financial Accounts: In 2022, 47% of adult men had registered financial accounts compared to only 13% of women (K-FIS).

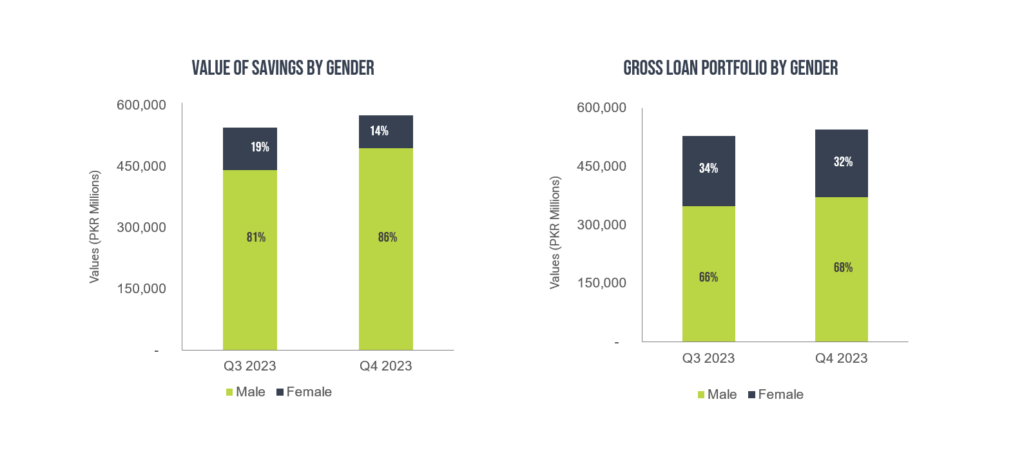

- Microfinance: Women borrowers receive much smaller loan amounts compared to men, with women savers comprising only 14% of total savings in microfinance institutions.

Source: Pakistan Microfinance Network

But Why So?

There are a multitude of reasons that explain the abysmal state of financial inclusion for women. It isn’t possible to cover the breadth of the problems but highlighting some key issues would serve the purpose.

Key Impediments to Women’s Financial Inclusion

-

Insufficient Supply of Finance for Women

- Shallow Financial Markets: Credit to the private sector in Pakistan has been on the decline with the trend only accelerating in the past two years.

- Limited Role of Commercial Banks: Commercial banks’ lack of interest in women’s financial inclusion.

- Low SME Credit to Women: Less than 5% of SME credit goes to women-owned businesses (ADB).

- Shift in Microfinance Lending: Movement away from women-focused group lending towards larger enterprises.

- Funding Shortfall: Diminishing funding for non-banking microfinance companies.

-

Policy Predicament

- Lack of Enabling Policy and Regulatory Environment: Gender-blind frameworks hinder women’s participation.

- Lack of Sex-Disaggregated Data and Research: Insufficient data for establishing baselines for women-led businesses.

-

Female Entrepreneurship

- Low Level of Female Entrepreneurship: Barriers include literacy, mobility, access to information, finance, cultural attitudes, time, capacity constraints, and limited business networks.

- Unified Access to Incentives: Challenges in providing incentives like refinancing schemes or tax benefits.

- Low Literacy Rates: Only 51% literacy for working-age women compared to 73% for men.

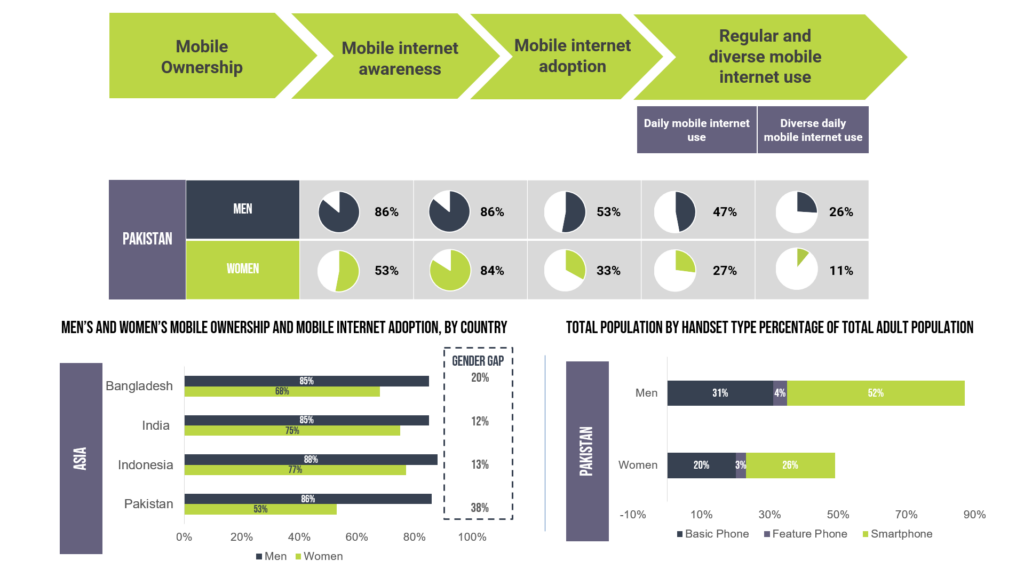

- Digital Inclusion: Women lag in mobile ownership and internet access.

The Economic Case for Women’s Financial Inclusion

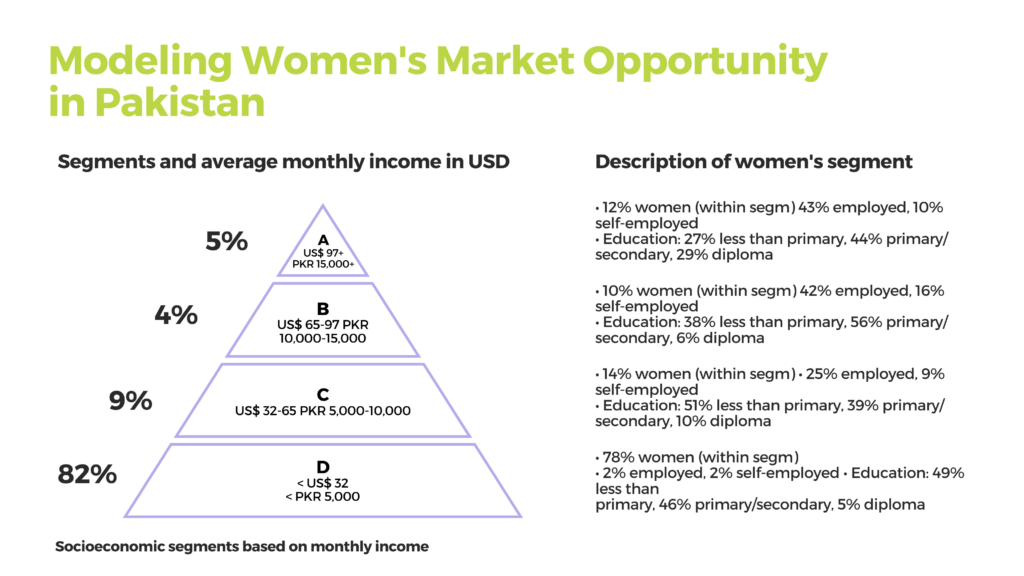

Empowering women through formal financial services can create significant economic opportunities. The IMF estimates that Pakistan could increase its GDP by 30% by fully empowering its female labor force. Financial service providers (FSPs) targeting the women’s market in Pakistan could potentially generate an annual revenue opportunity of $650 million (Rs. 101 billion).

Opportunities for Growth

Various segments of the female population offer significant opportunities. Women earning more than $97 per month represent a $124 million opportunity, while those earning less than $32 per month indicate a $320 million potential. Fintech companies can leverage these opportunities to fill gaps left by traditional financial sectors.

By addressing these issues, Pakistan can make substantial strides toward financial inclusion, benefiting not just women but the economy as a whole.