Part I: The B2B Online Grocery Segment

Introduction

The momentum in the grocery e-commerce segment in Pakistan has been underway for roughly five years, with players like MandiExpress, Sabzi.pk, and QnE operating since 2015. However, the COVID-19 pandemic and subsequent lockdowns helped startups see quick and significant growth. The food and grocery retail market in Pakistan made $59.3 billion in total revenue in 2018, constituting a compound annual growth rate (CAGR) of about 8.4% from 2014 to 2018.

Surge in Online Grocery Services

Although updated reports on these numbers for 2019/20 are unavailable, the market has experienced a surge in the use of both B2C and B2B online grocery services. In Pakistan, where grocery retailers typically rely on curbside deliveries by distributors every few days for procuring inventory, this presents traditional retailers and kiryana store (small mom and pop style corner stores) owners with several challenges.

Market Opportunity

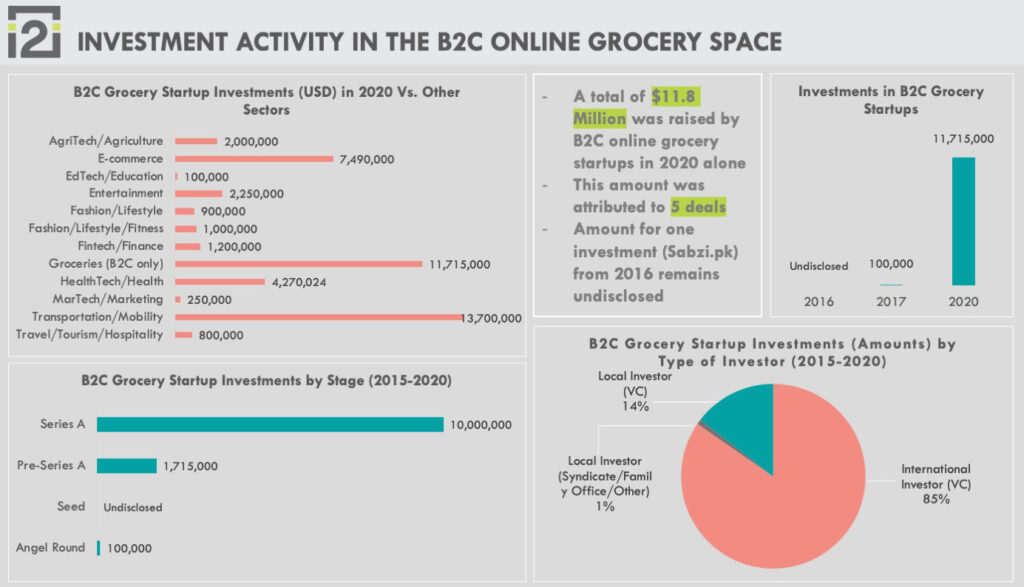

These challenges translate into an enormous market opportunity, and our Insights team sought to break down this complex landscape in Pakistan. This issue focuses on analyzing startups operating in the B2B grocery segment, particularly those servicing the large landscape of kiryana/grocery stores. According to investment data from i2i’s Deal Flow Tracker, a total of $4.3 million was raised by 5 B2B grocery startups in 2020 alone, accounting for 17% of the total investment amount raised this year. These startups include Tajir, Bazaar, MandiExpress, and Dastgyr. The sector remains largely male-dominated, unlike others such as EdTech and HealthTech. For details refer to Figure 1.

Fig 1

Industry Mapping and Key Players

Understanding this segment requires a look at the key players in the value chain: manufacturers, distributors, wholesalers, and retailers. The top tier of this supply chain is occupied by manufacturers like P&G and Nestle, which supply to major retailers and distributors. Large retailers, such as Metro and Carrefour, typically have direct relationships with manufacturers due to their capacity for bulk orders.

In contrast, kiryana stores have an approximate annual turnover of $3 billion, domestic convenience stores $200 million, and modern supermarkets $176 million (data from 2012). Distributors, with their fleets, delivery staff, and inventory, play a crucial role in getting goods from manufacturers to retailers and small wholesalers. Kiryana stores, at the bottom of this chain, often run out of stock and can lose business while restocking.

Startups Serving Kiryana Stores

The grocery retail industry is reportedly worth $125 billion annually, with the grocery sector alone worth $48 billion as of 2020. Out of an estimated one million shops in the country, at least 95% are kiryana stores, accounting for 70% of all grocery purchases. This presents an enormous opportunity for innovation.

For example, MandiExpress, operational since 2015, offers both B2B and B2C services, catering to consumers, restaurants, organizations, and other e-commerce platforms like Daraz. Similarly, Sabzi.pk provides delivery of fruits and vegetables through both B2B and B2C models.

Notable players like Tajir, Bazaar, RetailO, Jugnu, and Dastgyr service kiryana stores, providing online inventory procurement. Yasir Memon of Jugnu emphasized the importance of building solid foundations, while Saad Jangda of Bazaar highlighted the need to understand customer needs. Tajir and Bazaar provide price comparisons through mobile apps, empowering retailers by removing middlemen.

Challenges Faced by the Industry

Tax Evasion and Changing Demographics

As kiryana stores go online with the help of B2B grocery startups, they leave a digital trail that can track financial transactions and add them to the tax net. A survey by Jugnu indicated that a younger demographic is taking over these stores, using WiFi and social media apps like TikTok. This demographic is open to entering the tax net for the ease of doing business through B2B startups.

Disrupting the Middlemen

B2B grocery startups aim to disrupt the supply chain by reducing the dependence on middlemen. However, players like MandiExpress incentivize aartis (middlemen) with greater market access. Faisal Aftab from LIVC noted that startups need to work within the system rather than seeking to disrupt it immediately.

Potential for Disruption

On average, a kiryana store owner buys stock to last a few days from a distributor’s representative who visits weekly. If the stock runs out, the owner risks losing customers or incurs costs by visiting the wholesale market. B2B startups addressing this gap are game changers, allowing kiryana store owners to procure inventory online and have it replenished without leaving their stores.

Fig 3

International Comparisons

The B2B grocery sector has thrived in other emerging markets. In Egypt, MaxAB connects informal food and grocery retailers to suppliers, raising $6.2 million in seed funding. Indian startup Udaan raised $585 million in Series D funding with a valuation between $2.3 billion and $2.7 billion. These examples present a case study for the potential journey of the sector in Pakistan.

Conclusion

Stay tuned for our next issue, which will cover the B2C grocery startups and delivery space, highlighting how these segments tie together.

Stay tuned for our next issue to see how all of this ties in with the B2C grocery startups and grocery delivery space.

For this newsletter issue, our team interviewed some key investors and startup founders in the space including Faisal Aftab (Lakson Investment Venture Capital), Meenah Tariq (Karavan), Ali Mukhtar (Fatima Ventures), Saad Jangda (Bazaar), Yasir Memon (Jugnu), Sair Ali (Blink by Eat Mubarak), Muhammad Owais Qureshi (Dastgyr), and Furquan Kidwai (Dawaai).