Introduction: Why a Deal Flow Tracker? Why Now?

At Invest2Innovate, our research arm Insights is dedicated to closing the information gap in Pakistan’s startup landscape. In November 2019, we released the Pakistan Startup Ecosystem Report in partnership with the World Bank and the Women’s Entrepreneurial Finance Initiative (We-Fi). The overwhelming response to this report revealed a genuine demand for deal flow information, which is often not readily available or is difficult to track.

To address this need, i2i’s Deal Flow Tracker includes most (if not all) of the disclosed deals in the Pakistani startup ecosystem from 2015-2020 (July). This open-source, dynamic resource aims to make it easier for investors, entrepreneurs, and other stakeholders to make informed decisions in this market. We believe that evidence-based decisions will lead to success stories from Pakistan.

Overview

In the first quarter of 2020, many speculated that the COVID-19 pandemic would lead to a decline in startup investments globally, including in Pakistan. While there were delays in investments already in the pipeline, activity did not halt completely. As of July 2020, 22 investments were reported, compared to 30 deals in 2019. This is promising, especially considering the ongoing pandemic. In total, 122 deals worth $178 million were made from 2015-2020, with another 19 deals having undisclosed amounts. This brings the total deal count to 141. However, due to undisclosed amounts for some deals, our analysis uses $171 million as the total amount raised.

Key Findings

- Gender Disparity in Investment

- Out of the $171 million raised, 75% is attributed to male-founded startups and 15% to mixed-gender founded startups.

- Female-founded businesses accounted for 9% of the total deals but only 2% of the total investment amount.

- No Series A investments were raised by women-founded businesses from 2015-2020.

- Sector-wise Analysis

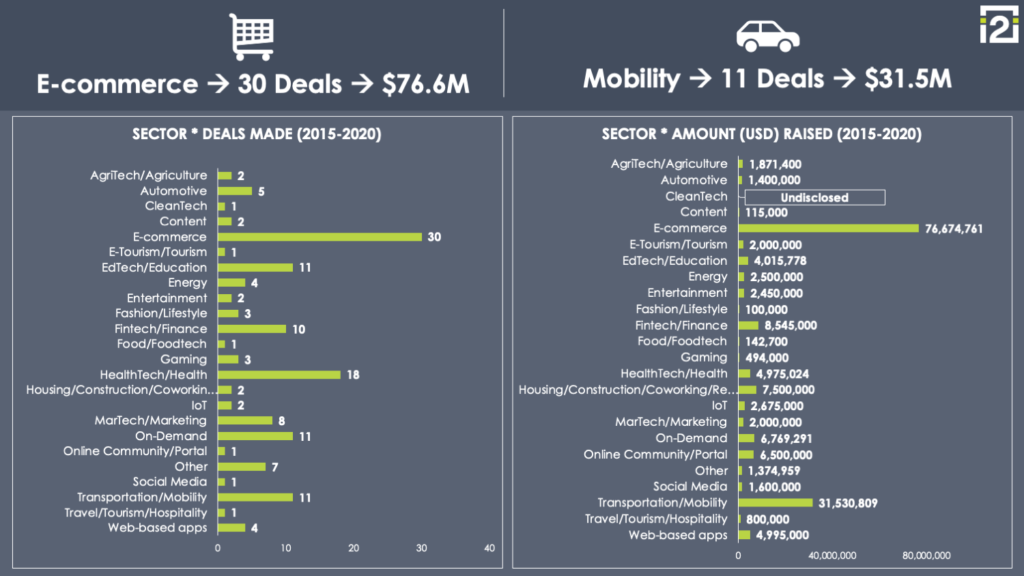

- The highest number of deals were in e-commerce (30), healthtech (18), edtech (11), on-demand (11), mobility (11), and fintech (10).

- E-commerce ($76.6 million) and mobility ($31.5 million) accounted for the largest total amount raised.

- E-commerce, healthtech, edtech, fintech, and mobility had more deals through local VCs than any other sector.

- Only e-commerce, mobility, fintech, edtech, and energy sectors raised Series A investments from 2015-2020.

Detailed Analysis

Investment Trends

-

Gender Disparity in Investment

The gender disparity in fundraising has been a persistent roadblock in nascent ecosystems like Pakistan. Although various support players are working to close this gap by offering investment readiness training for women-owned businesses, there is still much work to be done. According to our data, mixed-gender founding teams have shown a steady increase in participation in investment rounds. However, the persistent gender financing gap is not easily attributable to a difference in the quality of women-founded versus male-founded startups, indicating issues such as unconscious bias or a funnel issue.

Female-founded startups often raise investments from local angels, VCs, and accelerators/incubators. In contrast, male-founded startups raise from a variety of investors, including international angels and VCs, which constituted 65% of the total investment from 2015-2020.

-

Sector-wise Analysis

Based on the number of deals, e-commerce (30) and healthtech (18) lead in deal count, while e-commerce ($76.6 million) and mobility ($31.5 million) lead in total amount raised. This suggests that sectors with more deals, like healthtech, raised smaller investment sizes compared to sectors like mobility.

E-commerce and healthtech accounted for 33% of seed investments. The only sectors where startups raised Series A investments from 2015-2020 were e-commerce, mobility, fintech, edtech, and energy.

Importance of International Investors

International VCs contributed significantly to Series A funding in Pakistan, with $20.1 million raised from international VCs compared to $19.95 million from local VCs over the past six years. International angels also played a crucial role, contributing $16.3 million and backing four Series A investments.

Conclusion

The data highlights the need for more inclusive investment practices and the importance of international investors in the Pakistani startup ecosystem. By addressing gender disparities and supporting diverse sectors, we can foster a more vibrant and equitable investment landscape.

Thanks and please share this far & wide – let’s make the Pakistan Startup Ecosystem much easier to understand & access for everyone’s benefit!

Pingback: เครื่องฉีดน้ำแรงดันสูง ยี่ห้อไหนดี

Pingback: เครื่องอบผ้า ยี่ห้อไหนดี

Pingback: buy magic mushrooms online Australia

Pingback: raja bandarq

Pingback: Couples massage near me

Pingback: kode alam

Pingback: นำเข้าสินค้าจากจีน

Pingback: บุหรี่นอกเก็บเงินปลายทาง

Pingback: ruby disposables cz 457 chassis cz75 kadet cz 457 provarmint cz accushadow ruby gmo cookies ruby goat milk disposable psl rifle for sale köpa stesolid utan recept fidel runtz strain

Pingback: Weed for sale online

Pingback: ติดเน็ตบ้าน ais

Pingback: Buy crystal meth online (Methamphetamine crystal).

Pingback: kingdom66คาสิโน

Pingback: buy iget cart

Pingback: Library

Pingback: Hunter898

Pingback: pool villas in phuket

Pingback: เรียนภาษาญี่ปุ่น

Pingback: MEG ทางเข้า เว็บสล็อตใหม่ MegaC4

Pingback: เช่าเรือสปีดโบ๊ท,เช่าสปีดโบ๊ท เจ้าพระยา,เรือเช่าเหมาลํา เจ้าพระยา

Pingback: phuket cannabis

Pingback: ชาภู่หลาน

Pingback: slot

Pingback: Springfield blemished-guns

Pingback: RFID Warehouse Management