E-Learning & its Future in Light of COVID-19

Since the outbreak of COVID-19 this year, students of all ages have been confined to their homes for months on end. Lower income schools, in particular, are having a difficult time keeping their students engaged, and most if not all, do not even have a Learning Management System in place for basic remote information sharing with students and/or parents. Those students attending schools that do have such management systems in place (even in higher education) have expressed dissatisfaction over the quality of learning being imparted. The government’s attempt at mass instruction that includes a national public TV channel to broadcast Pakistani school lessons has also raised a lot of questions. While it covers content from kindergarten to high school with one hour of curriculum for each grade, students have to take turns to watch their lessons, and we have yet to measure the impact of this approach on learning outcomes.

On the other hand, Sindh government launched an android mobile learning app for students Kindergarten through grade 5 in late May this year, which is not even reaching 50% of the overall students population in the province. Similarly, higher education is suffering the same fate at the moment. Due to countrywide lockdowns, the Higher Education Commission (HEC) announced on March 30th that all educational institutions (with sufficient resources and robust learning management systems) would start delivering online courses. At this point, many affluent private educational institutions (at all levels) have already moved to remote learning solutions, HEC’s directive highlighted a serious lack of contingency planning using good quality remote learning methods among most higher education institutions. This is something that predominantly affects students from lower socio-economic strata (SES) much more than it does any other strata.

On top of all of this, Pakistan has the second highest out of school children (OOSC) rate (more than 40%) in the world and out of those going to school less than 20% of the 3rd graders can read and comprehend a short passage. Therefore, the government’s efforts, while a step in the right direction, are far from sufficient and seem very fragmented in the way they are being executed. For one, there is no unified national education strategy that has come out since the pandemic despite some preliminary evidence suggesting that the virus will have a longer term impact than we originally predicted. On the other hand, Pakistan’s education industry, which is typically slow to innovate has become highly volatile in the aftermath of COVID-19 and has therefore created a number of opportunities for digital and tech-based learning solutions.

Overview of Common EdTech Business Models

Invest2Innovate’s earlier study on COVID-19 and its impact on Pakistani startups reported that EdTech was among the few sectors that did not suspend services since the pandemic. Out of the EdTech startups that participated in the study, 69% (9/13) reported not suspending services because of the pandemic. For this newsletter, i2i conducted a follow-on survey to understand these EdTech startups’ offerings and to see where they stood a few more months into the lockdown. Out of 10 EdTech startups that responded, the majority operated on either a B2B (33%) or B2C (29%) model, whereas B2NGO (14%), B2G (9%), and blended (9%) models were the less common ones. It is important to note that B2NGO models are commonly seen in developing countries like Pakistan, where not a lot of formal investment is made into education/EdTech businesses and often the companies themselves opt for development funds etc. as they provide a wider and easier access to not only grant funding but also to public sector schools.

Data gathered from these startups also showed that there is a greater focus on K-12 than any other grade level such as Pre-K, tertiary and higher education. Two of the startups surveyed pointed out that they do not focus on a specific grade at all. Overall, 70% of the startups target a particular grade level while 30% do not, and all of the participating startups reported having a paid offering (product/service). In terms of the categorization of clientele of these 10 startups, 3 startups that voluntarily shared the size of their B2C users showed that they were catering to a total of 16,000 students across the country, which did not include students impacted through B2B, B2NGO, and other models. On the other hand, startups with a blended or B2B model reported catering to seven NGO clients (3 startups), whereas six startups said they worked with a total of 5,315 schools – making up 2% of the total number of institutions in the country. The number will come out much higher if more EdTech startups are accounted for.

Key EdTech Startups in Pakistan & their Offerings

Several startups in Pakistan are using this opportunity to either offer independent learning solutions or are partnering with other players such as government institutions, telcos, and NGOs. The current circumstances created by the pandemic have put further emphasis on the role of such startups in grappling with a massive need for learning solutions as education institutions remain closed and many have shifted to remote learning. Startups that have already been leveraging technology to build distance learning solutions – often increasing accessibility and affordability of education – are even more important in the midst of this pandemic. For instance, Edkasa (founded in 2018) not only uses virtual classes to offer a personalized and interactive learning experience for higher secondary level students but also provides access to 800+ videos containing free STEM learning material through YouTube. Knowledge Platform, established in 2003, provides its services to over 1500 schools around the world and essentially focuses on the most economically marginalized students in K-12 education. KP has also implemented their blended learning solution in 75 all-girls government schools in Islamabad through the Jazz Smart Schools project. Recent sources have noted that the company has a current user base of approximately 650,000+ K-12 learners in Pakistan, China, The Philippines and Myanmar. Their game-based learning platform Learn Smart Pakistan – which consists of many educational games, animated videos, and activities – has a user base of 80,000 students and 400 schools. Interestingly, where it took this program 2 years to get to 400 schools, it has only taken them a month to expand to 650+ schools because of the current situation. Other than this, Knowledge Platform employs a really interesting and modern adaptive assessment system that customizes learning to each student’s experience and assessment. All of these factors make KP not only a pioneer in the sector but also a leading startup that has scaled in the ecosystem.

Other notable startups with high-quality learning interventions for a younger audience (K-8 and under) include Taleemabad Learning app by Orenda), Muse by Sabaq (learning app for grades K-5), and KarMuqabla (interactive gaming modules and free digital textbooks for grade 5 to 8). Taleemabad, with over 125,000 users engages learners with a cartoon-based mobile phone application to teach the national curriculum in a visual and more engaging way. Sabaq’s Muse that has impacted 252,233 students across the country promises to improve student engagement and learning outcomes for Math, Science, English, and Urdu delivered in Urdu, Sindhi and English. Dot&Line (that offers in-person as well as online classes to students from grade 2 – 7) had to take their learning completely online in the aftermath of the lockdown in March. While they reported decrease in their in-person learning centers revenue, online class subscriptions have increased significantly. Another notable EdTech startup is Queno that manages class activities and updates parents on their children’s progress through their app.

It is important to note that EdTech companies such as Sabaq, Orenda Project, Sabaq Foundation and Knowledge Platform have all made pro-bono contributions to the content used by the government’s Teleschools program since its launch in early April 2020. Although a positive gesture on the startups’ side, the government must devise a more long-term education plan that leverages robust technology and partnerships with startups like these.

Investment Landscape

Lockdowns following the spread of coronavirus led to schools worldwide being shut down due to safety concerns, which impacted 1.4 billion students worldwide. As lockdowns increased the demand for and favorability of online learning solutions, EdTech startups have seen a considerable uptick lately. In countries where the virus was controlled and the risk decreased, schools have reopened with precautionary measures in place such as distancing seats, teaching classes outdoors, wearing masks, conducting temperature checks, etc. Some of these countries include Japan, Denmark, China, and Israel. However, for developing countries the risk may be much higher due to insufficient financial resources, possible lack of monitoring to ensure SOPs are followed through, etc. It is therefore unclear at the moment how much longer it will take for schools to reopen fully, which makes the role of EdTech startups and other stakeholders providing digital learning solutions really important.

In a study by Invest2Innovate earlier this year, out of 13 EdTech startups that participated, 54% expressed that they were expecting to raise funding despite the pandemic, while 53% reported having a cash runway of 6-12 months. Additionally, 77% of the EdTech startups that participated had also pivoted their business model in some way due to COVID-19 and 85% already had an alternative offering for the market according to a survey that was conducted back in March. The majority of the EdTech startups surveyed (9/10) for this newsletter reported a 20% – 100% growth in users during the past 3 months. Similarly, most of these startups (9/10) witnessed a 1.5X to 3X increase in amount of usage since the lockdown was implemented. See the figure above for details. A combination of these factors makes EdTech an exciting and potentially lucrative sector for investors.

Well Funded EdTech Startups in Asia & Comparison with Pakistan

Deal flow data collected previously by i2i shows that a total of USD 2.65 million has been raised by 6 EdTech startups in a total of 8 deals. The highest amount of investment on this list is attributed to Knowledge Platform which raised around $2 million in 2019. The findings also showed that with the exception of Dot&Line and Knowledge Platform, all investments were raised from either local or international angel investors. Many EdTech startups have either won grants, awards, or have partnered with development funds, which are not accounted for in this data. Since the sample size is quite small (while is still representative of the universe of EdTech startups in Pakistan), it’s important to see if the findings hold up with a larger sample size.

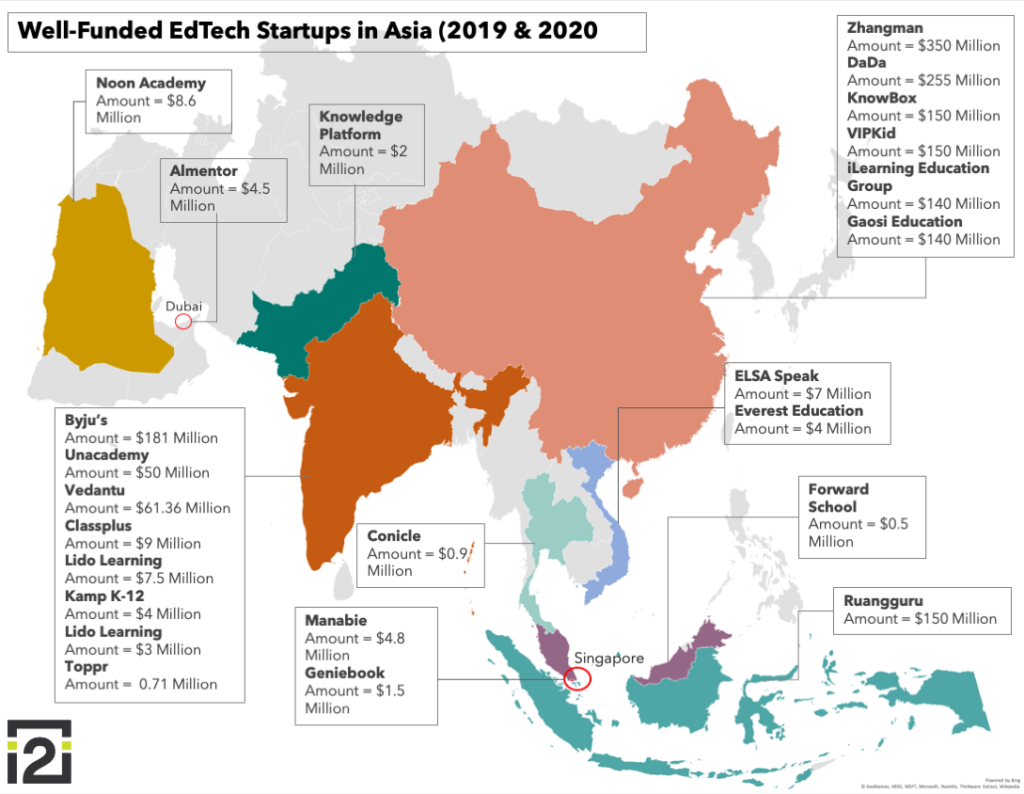

Analysis of deal flow data of some well-funded EdTech startups in Asia shows that China comes out on top in terms of amounts of investments. Startups such as Zhangmen, Dada, KnowBox, VIPKid, iLearning Education Group, and Gaosi Education raised investment that ranged from $140 million to $350 million. The only two non-Chinese EdTech startups that came close to the size of investments raised by Chinese startups in 2019/2020 were Indian BYJU’s ($181 million) and Indonesian Ruangguru ($150 million) – with Byju’s raising twice from different investors in 2019 alone. BYJU’s makes an interesting case study for many startups in South Asia that are trying to raise investment and scale their companies. While several factors have contributed to the success of the company, one factor that really stands out is their lessons that were created using various board-approved syllabi from different states in India. Roughly 90% of the content is evidently common across curricula, which helps it map the same content into varied curricula, making the solution highly scalable. Similarly, other Asian countries such as Indonesia, Malaysia, Thailand, Singapore, Vietnam, etc. are also producing a significant number of EdTech startups. Many of these have managed to raise substantial amounts in investment over the past few years, particularly in Indonesia. The Middle East – while not too prolific when it comes to quantity of EdTech startups – accounted for two companies that raised a significant amount last year. Noon Academy is one of these startups (based in Saudi Arabia), which raised an investment of $8.6 million in 2019, while another EdTech startup based in Dubai called Almentor raised $4.5 million the same year. See figure below for details.

Although this growth in investments in the sector is a great sign, it also means that there are more startups seeking investment than there is capital. In reference to this issue, Faisal Aftab in his interview with i2i, pointed out that it might be a good idea for EdTech startups in Pakistan to look to the Middle East for raising investment where the situation will perhaps be the opposite, i.e. more investment capital and fewer players in EdTech. Another key difference in investment trends between more developed ecosystems and nascent ones is that the former represented increasing overall capital that was concentrated in fewer deals, i.e. larger late-stage rounds of funding. In 2019, it was reported that $6 billion of venture capital funding was poured into EdTech globally, which was twice the amount invested in the sector in 2017. It is fair to say then that investment in this sector will most likely increase in the coming years especially considering the near de-capacitation of the traditional (brick and mortar) educational institutions that has catalyzed the digital transformation of the education sector.

Barriers to Scale

Although Pakistan’s entrepreneurship ecosystem has seen a number of high quality EdTech startups emerge, it has not yet succeeded in producing one that has achieved scale – at least not as rapidly as needed. While discussing possible hurdles to scale in an interview for this piece, Mahboob Mahmood, founder at Knowledge Platform, highlighted that in Pakistan the focus has mostly remained on content, whereas a scalable EdTech startup often requires both good content and robust technology. For instance, if a startup wants a school system to use their product, then an approach centered solely on a mobile phone app most likely won’t lead to adoption as opposed to a larger and more robust learning system. Similarly, Faisal Aftab (Managing Partner of Lakson Investments Venture Capital) also noted that platforms usually are much more powerful and often more successful than other categories of EdTech startups. He also emphasized the significance of information and communications infrastructure that serves as the backbone when it comes to equitable distribution and use of EdTech.

This point was echoed in a study/report published by Omidyar Network’s Education initiative that highlighted elements such as basic electricity, telecommunications infrastructure, internet access, and EdTech hardware access both in and outside of schools as key factors that enable scale in EdTech. I2i Ventures’ Investment Manager, Asad Jafri highlighted in an interview for this newsletter that internet access remains one of the key barriers to adoption in Pakistan and similar developing countries. “A rickshaw driver’s child – on the off chance that he has access to his/her parent’s phone – will most likely not have access to the same features, services, etc. as a learner from a higher socio-economic strata (SES)”, he noted. In literature, this has been called ‘digital inequality’, ‘internet inequality’ or ‘digital divide’. The idea is based on the premise that different demographics and socio-economic variables such as education, age, gender, income, and infrastructure impact how the internet is accessed and used. Sub-dimensions of internet inequality including “autonomy of use, availability of social support, variation of use at different locations of Internet access (school, home, Internet cafe, and combinations of these locations) and Internet self-efficacy (ISE)” are not only known to have a significant correlation with each other but also have been established to vary among different groups (i.e. disaggregated by age, gender, SES, etc.). Removing these barriers on a national scale could open a lot of doors in EdTech.

Pingback: holosun 507k

Pingback: พัดลมหลังคา

Pingback: ดูซีรี่ย์

Pingback: ปัง ปัง สล็อต

Pingback: chocolate psilocybin