The rules are changing within the e-commerce space. Is the future of retail and e-tail one and the same now?

Hello friends, colleagues and co-conspirators!

In May Amazon opened doors to its first New York City bookstore, Amazon Books. As I stood line waiting to get inside the Columbus Circle shop, the irony was not lost on me. Amazon made a business out of putting traditional bookstores out of business and here we were a little more than two decades later at the company’s own brick-and-mortar store. This isn’t Amazon’s first foray into retail – last year the e-commerce giant launched Amazon Books in Seattle (stores are now open in multiple locations across the country) and also revealed plans for a mobile-checkout based grocery store in the city. On June 16, Amazon shook-up the market once again by announcing it’s $13.7 billion acquisition of the supermarket chain Whole Foods. Through this deal Amazon has further solidified its retail footprint via 465 physical stores.

From across the board traditional retailers have also long been looking for the recipe to expanding their online reach and may be closer than ever before to cracking the problem. On the same day as the Amazon acquisition was announced, retail giant Walmart acquired popular menswear e-tailer Bonobos for $310 million. These deals bring into sharp focus how the battle for consumers and market share is now being fought both online and offline.

So what impact will these emerging e-commerce trends have within the Pakistani market? In our Insights Industry Brief released earlier this year, we concluded that the difference between success and failure for local e-commerce startups will lie in their ability to seamlessly integrate online and offline experiences for their customers. Two of the most successful e-commerce platforms in Pakistan have seen success by leveraging this strategy. Daraz.pk hire agents/employees who serve as the offline link to the brand and Zameen.com partners with brick-and-mortar agencies to gain greater visibility and provide customers with a tangible offline presence. Both companies have won great traction and closed multiple rounds of investments as a result. We further noted that the local players would do well by not trying to reinvent the wheel by trying to get customers to directly jump online. Instead, the more fruitful strategy would be to capitalise on the moves being made by traditional businesses into the e-commerce space. These players are generally not strapped for cash, and they already have the required brand recognition and customer buy-in, which makes it easier to develop their online channels.

Amazon is spreading its reach wider still through its recent acquisition of middle eastern Souq.com and via investments within the Indian market that total a whopping $5 billion. It’s not just Amazon thats competing for more brick-and-mortar presence, Alibaba has also been consolidating its efforts via key investments, partnerships and acquisition. In our last newsletter we talked about the Chinese giant’s potential interest within the Pakistani startup space, and more specifically e-commerce space. Local players would do well to track emerging trends within the sector, incorporate latest lessons and focus on the gaps within the industry rather than launching another online platform or marketplace. The needs of the market and investor interests are evolving fast and our startups need to evolve with them. For more on the local e-commerce space, case-studies and emerging trends you can now buy our detailed industry brief at a discounted price for our subscribers here.

Read on for more on trends and investment activity within the e-commerce space and as always write back with feedback and suggestions. Also have more to say on the topic? Or just share some interesting research/articles with us? Give us a shout!

Cheers,

Anusheh Naveed Ashraf

Head of Insights, Invest2Innovate

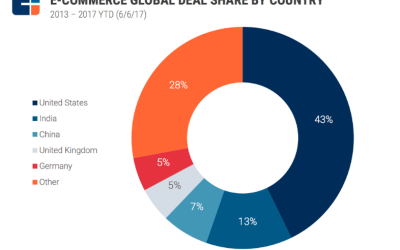

This pie-chart rounds up the investment deals within the ecommerce space since 2013. With 43% of the total deal flow, the US remains the winner. However in 2017 the three largest deals have been in Asia: $1.4B Series J to India-based Flipkart; $1.1B private equity round to China based Koubei; and a $500M private equity round to China-based Uxin Pai. While the last year saw a slump in e-commerce investment activity, predictions suggest that 2017 will lead to a comeback. For more on trends take a look at The Future of Ecommerce webinar link shared in the next section.

Interesting Content from Across the Interweb

Here is a round-up of some of the most interesting content on Amazon’s strategy and the ecommerce space in general.

Amazon’s New Customer

This article carefully unpacks the online-shopping giants goals, strategies and tactics. It also puts in perspective the company’s recent Whole Foods acquisition and talks about what we can expect in the long-run. Interested in reading more on the topic? Take a look at this CB Insights Strategy Teardown and this article on the possible disruptions Amazon will be bringing across industries.

The Future of E-commerce

If there is one thing we can be sure about, it’s that e-commerce is going to evolve in new and sometimes surprising ways. CB Insights takes a closer look at the macro trends and investment activity within the space in this webinar to help your business be better prepared. After all you know what they say – knowledge is power!

11 Trends That Will Shape SouthEast Asian E-commerce In 2017

Last mile logistics, online payments solutions, direct-to-consumer (D2C) models and face-offs between Alibaba and Amazon. This article has the round-up on all this and more. With the CPEC deal, Alipay’s entry and potential Alibaba acquisitions within the Pakistani space we will see many of these trends have implications within our ecosystem.

A New Frontier

Uzair M. Younus, our Insights Fellow, who worked with us on the i2i Ecommerce Industry Brief wrote this piece about Pakistan’s ecommerce potential and some of the ways forward. It’s a great primer on the topic and introduction to the report.

Pingback: แทงหวย

Pingback: ขายคอนโด

Pingback: โปรแกรมห้องเช่า

Pingback: https://www.opinionstage.com/luizamatiza/qual-seu-tipo-de-paleta-de-cor-preferida?embedded_in=https://rentcars.buzz/

Pingback: varning för lyrica

Pingback: เล่นหวยกับ เว็บ Mahachoke99 ดีอย่างไร?

Pingback: ชีทราม

Pingback: UV Fluorescent dyes

Pingback: เกมส์เด็ดแตกหนักแตกดีที่สุด

Pingback: ผู้ช่วยพยาบาล

Pingback: ตี๋น้อย 168 เว็บตรง จากแดนมังกร พร้อมให้บริการทุกการเดิมพัน

Pingback: LOTTOVIP

Pingback: ข่าวบอล

Pingback: TUCSON HEARTBURN SURGEON

Pingback: adhd testing virginia

Pingback: order meat online

Pingback: สล็อตวอเลท