FinTech in Pakistan is so hot right now – or is it?

Hello friends, colleagues and co-conspirators!

Last week, Pakistan’s financial technology (fintech) space made a great stride forward with the launch of the SimSim digital wallet. This digital wallet is exciting news because (1) It received regulatory approval from the State Bank of Pakistan and (2) It was the result of a unique partnership between FINCA Microfinance Bank Limited and FINJA Pvt. Limited. Translation = It was the first time a bank and a fintech company partnered together in Pakistan to design a digital financial product. Traditionally, we’ve seen both sectors try to go at it alone when it comes to creating and launching digital solutions – this approach hasn’t been effective thus far. This is also not effective given that only 1% of Pakistan’s population has access to credit cards according to the figures provided by the State Bank of Pakistan for 2015. Putting this number in a regional context, for most countries in Southeast Asia the credit card penetration is less than 5%. However in Singapore, considered a leading fintech hub in Asia and a rising star within the space globally, this figure is at 38%. On the other side of the spectrum, when we talk about less traditional digital banking solutions like EasyPaisa and MobiCash in Pakistan, acceptance and usage numbers still remain low.

If we looked at these numbers on their own, it might seem that the odds as well as our cultural realities are stacked against the success of digital financial solutions in the country. But i2i’s recent research into the e-commerce ecosystem would suggest otherwise. In our conversations with CEOs/Founders of leading e-commerce platforms, many noted that while typically 90% of transactions remain Cash on Delivery during Black Friday deals, when prepaid payments are incentivised, the numbers get flipped on their heads. This suggests that the problem isn’t trust or a cultural preference for cash, but instead it’s a question of incentives. While it may not make business sense to continuously encourage people to use alternative/digital payments solutions via subsidies, incentives can be provided via design and functionality that truly engages consumers. As an ecosystem, we still don’t have access to enough data around this. If the data does exist, only specific players have access to it. This means that most of the smaller companies are essentially going in blind when trying to innovate and create new fitech solutions and are less likely to achieve a breakthrough in the space.

At i2i, we believe that a critical first step is to carry-out data driven research into the payments, banking and m/e-commerce industry. While there is some macro-level data publicly available, no one has delved into micro-level data points and looked more specifically into mobile user behaviour. We want to answer questions like, How are current users engaging with payments solutions? What does the customer persona of a Pakistani mobile user look like and what implications it can have on the development, design and usage of FinTech solutions? We seek to capture ‘why’ in our data gathering and insights, not just ‘what.’ Moreover, opening this quantitative and qualitative data to everyone ensures that the entire ecosystem is pushed forward. Additionally, a study of this nature can be used as a launching pad for initiating the required policy dialogues. Backed by concrete numbers, the case for reform can be made more compelling. We are currently looking for partners and sponsors for this study, if you/your organization are interested shoot us an email at aashraf@invest2innovate.com.

Read on for more on trends and investment activity within the fintech, especially payments, space and as always write back with feedback and suggestions. Also have more to say on the topic? Or just share some interesting research/articles with us? Give us a shout!

Cheers,

Anusheh Naveed Ashraf

Head of Insights, Invest2Innovate

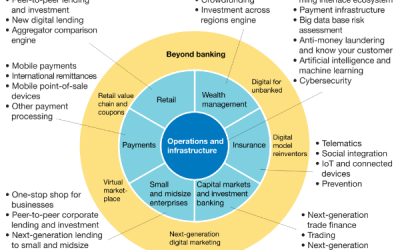

While fintech in Pakistan remains in its nascent stage, globally the industry is maturing. As the market matures the rules of the game will change as well and McKinsey & Company is looking to the future. In this infographic, they round-up the key trends that are going to be shaking up the space. Of special note, among the seven critical changes that the company highlights, is improving collaboration through greater team-ups between traditional financial institutions and fintech companies (as we saw in the Finca/FINJA partnership for example) and an expanding scope, AKA a shift from merely looking at frontline activities and designing solutions throughout the value chain. You can read the entire article here.

Interesting Content from Across the Interweb

Here is a round-up of some of the most interesting content on SimSim, payments and FinTech.

A Review of the SimSim Wallet

This article by ProPakistani walks you through the SimSim wallet and details some of the ambiguities about functionality. As a (until recently) broke grad student in the US I loved using a myriad of FinTech apps like PayPal, Venmo and MINT to transfer funds, settle my share of bills and manage my finances. So of course, when the SimSim wallet launched I was eager to give it whirl. Personal first thoughts are that it’s a great first-step. It’s not the most intuitive app design but I think with time has immense potential. My two big suggestions would be to introduce optional in-app tutorials and sticking to current functionality. I’m referring to Finja’s plans revealed in recent interviews about turning the app into a investment portal etc., which would be trying to address way too many things with just one app (IMHO).

Opportunity Landscape for Payments in Pakistan

In this piece Faisal Khan, who is not only a leading expert within the fintech space but also our advisor & consultant for the i2i Payments study discussed earlier, makes the case for the need of more data in the space. He also examines the opportunity within Pakistan by comparing it to two similar markets, Iran and Turkey. While the article is slightly dated, it’s still very relevant.

Global Fintech Report Q2′ 2017

If you’ve been reading these newsletters regularly you might have noticed that I’m a little bit of a fan when it comes to CB Insights and the research they’ve been churning out. While the company made a recent announcement that all of their analysis will soon only be available to paid customers (I’m heartbroken), for now this awesome report on fintech trends and investment activity in the space is still available for free.

Pingback: clenbuterol achat

Pingback: cvv sites

Pingback: http://bonanza178.pl/

Pingback: benelli m4 price

Pingback: acheter buprenorphine en ligne

Pingback: qiuqiu99

Pingback: Betflix ค่าย สล็อต คาสิโน ออนไลน์ ต่างประเทศ เล่นที่ LSM99

Pingback: รับแพ็คสินค้า

Pingback: injury attorney

Pingback: คาสิโน 168

Pingback: คา สิ โน สล็อต

Pingback: ปั้มไลค์เฟส

Pingback: fryd pens

Pingback: สมัครตัวแทน Relx

Pingback: หมอไก่ทำตา

Pingback: qiuqiu99 bandar

Pingback: คาสิโนสด

Pingback: ราวตากผ้าพับได้

Pingback: sudoku

Pingback: ทินเนอร์

Pingback: magic mushroom grow kits australia

Pingback: สล็อตเบทฟิก

Pingback: ทดลองเล่นสล็อต

Pingback: 220.lv