Is solar the way forward in addressing Pakistan’s energy crisis?

Hello friends, colleagues and co-consiprators!

In Pakistan LOL means Loads of Load-shedding (bad joke, I know but if I had a penny for every time I got this joke via SMS, you get my drift). For the uninitiated, us Pakistanis experience deliberate rolling blackouts because we do not produce enough electricity to meet our domestic needs (Can you imagine my reaction when I first found out that all those fancy stores on Fifth Avenue kept their lights on while closed, all night… every night?). Many areas of Pakistan have experienced 16-hour-long power outages and much of Pakistan Muslim League – Nawaz’s (PML-N – the current party in power) campaign for the 2013 elections was based on the promise of eliminating load-shedding once and for all. Yet as the 2018 elections fast approach power outages remain a daily struggle for many Pakistanis. Many others in the country remain off-grid or have limited access to the national grid (70% of Pakistan’s population spread over 50,000 villages).

In such a situation, turning towards renewable energy solutions is not only a matter jumping on the bandwagon of buzzwords like sustainability and green/clean energy, but more of a critical need to address our energy deprivation. The case for solar energy is especially strong when we consider the very favourable solar irradiation – the power per unit area received from the Sun (5.3 kWh/m²/day). According to estimates by the Pakistan Alternative Energy Board, solar potential in the country is 2.9 million MW (Wind potential is 340,000 MW). While talks of the government planning to expand the grid have been circulating for years, we haven’t seen any concrete work being done on the ground yet. Arguably, expanding the grid may not even be the smartest move to make. Take the example of Rwanda, where the government has pivoted from the role of provider of energy to facilitator and regulator of private-sector provision through off-grid solar home systems.

Potential doesn’t always mean the market is primed for solar solutions, however. Take the example of the US market where residential solar has failed to take-off due to high customer-acquisition costs (due to it not being a need since all power needs are already being met by the grid), unfamiliar technology and complicated policy and regulatory frameworks (e.g., net metering which allows consumers who generate some or all of their own energy to use it at anytime rather than when it is generated). In Pakistan, while some commercial and industrial and residential solar projects (and startups working in the space) exist, they remain few and far between, often because these solutions tend to be too expensive for consumers and startups (very capital intensive). For the average homeowner, solar remains even further out of reach considering banks are usually averse to providing home-loans particularly of the amount that it would take to install a solar system. Companies have also experimented in setting-up solar (and wind) farms in Pakistan and supplying this energy back into the grid but due to government tariff issues players have started to steer clear of that space.

But with all the rising awareness around climate-change (Pakistan is the 7th most vulnerable country to face issues of climate-change), increasing conversations around sustainable cities, SDG Hackathons and the 4th Industrial Revolution, what does all this activity mean for the startup space? The bulk of startup activity is currently concentrated on providing off-grid solar solutions. Among the factors that make this space attractive are 1) no regulation if you’re selling products and not electricity and 2) duty exemptions on solar panels, batteries, LEDs (although the experts I spoke to while researching this Insights issue tell me this remains problematic as the government has in the past changed duty exemption structures suddenly which has resulted in massive costs to startups).

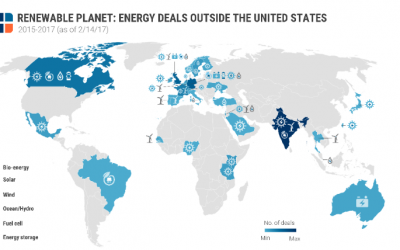

On the other side of the equation, funding also remains a challenge. According to a trends report on renewable energy investment by the United Nations Energy Program & Bloomberg New Energy Finance, investments in the sector constituted 55% of all energy-related investments ($241.6 billion, with solar and wind power being the leading sub-sectors) in 2016 globally. While investment in Pakistan is generally hard to come-by due to the risk perception around the country, it becomes even harder to raise angel or VC funding when it comes to physical goods/products according to experts working in the sector. Globally, China is the most attractive country for renewable energy investments (followed by India and USA respectively) according to a recent report by EY signalling that the country is making the sector a priority and also making important headway. However, when it comes to CPEC (China-Pakistan Economic Corridor) funding in energy projects, a majority of the investment is being made in coal-based plants with a few wind and solar projects in the mix. To me that indicates a lack of foresight on the government’s part (probably due to the allure of the low-hanging fruit with the new elections just around the corner). The need of the hour is for the government, private sector and startups to work collectively to ensure that renewable energy solutions become a priority. A good step forward is the government introducing net-metering policy in line with global standards, but a lot more support will need to be given on financing solutions so that there are enough households that convert to solar-systems and provide energy to the grid. A shift will need to happen from the current project financing structure, which allows big private sector firms running plants to be able to get easy access to funding while startups struggle to raise and remain marginalised in all other areas apart from off-grid solution provision.

Read on for more on trends and investment activity within renewable energy and clean tech, especially solar, space and as always write back with feedback and suggestions. I’d also like to take this opportunity to thank Jeremy Higgs, Co-Founder & Director of Operations at EcoEnergy and Salman Tariq, Energy sector consultant for all their invaluable input and insight on the sector and helping me demystify the space.

Have more to say on the topic? Or just share some interesting research/articles with us? Give us a shout!

Cheers,

Anusheh Naveed Ashraf

Head of Insights, Invest2Innovate

This figure breaks down money coming from Venture Capital and Private Equity funds into the renewable energy space. Solar continued to the most invested sector with $2.3B, however, this was down 2% from the previous year. The overall investment in the space totalled $3.3B in 2016 which also marked a 4% decrease. For more global trends in the space read the full report by UN Environment and Bloomberg New Energy Finance here.

Talking Data

- the number of unicorns, companies valued at $1B+, in the solar space. Indian startup ReNew Power Ventures is now valued at $2B after having closed a $200M round from Tokyo-based venture firm JERA in the first quarter of 2017.

- The number of CleanTech companies that have gone through i2i’s accelerator program namely RES, EcoEnergy and JAAN Pakistan. The latter two are still operational and doing well.

- the number of startups (according to data available publically) in the Pakistani renewable energy space that have raised investment. 2 of these investments were made into Nizam Energy and SRE-Solutions (both by Acumen). The remaining two are Step Robotics (invested in by LMKT) and i2i Accelerator alumni EcoEnergy.

- $600k – total equity investment raised by EcoEnergy. They also currently have $400k in debt investment with plans to raise more by the end of the year.

From Our Readers

Every month we get some really interesting and insightful emails from our readers (In fact, the theme for this newsletter was inspired by one such email exchange with our reader Waqas Abid, Commercial Manager for Reon Energy Solutions). We’ve decided to feature responses from readers that we think will add-value and present an interesting picture to our readership. Below is a response to last month’s newsletter on ride-hailing:

“Great newsletter as always.

The one thing that you forgot to mention, and I believe it is VERY important in the context of ride-hailing, is that the “investment” is really a subsidy to drivers/riders. The goal is to corner the market through increased supply of drivers – the more drivers you have, the shorter user wait times, the more likely a user is to use you, and the greater are the economies of scale of running and maintaining your technological operations.

That subsidy, however, is an inefficient use of resources (like all subsidies). In the ride-hailing case, at some point in time the subsidy will go away, leading to an increase in fares in a sector that is monopolistic in nature. This downside of the current business model of ride-sharing is something a lot of people miss, and one that people should be made aware of.

Rather than using most of their investment capital to innovate on the technological and operational side, majority of capital is used to subsidize car rides. This is inefficient and unsustainable.”

From

Uzair Younus

South Asia Analyst at Albright Stonebridge Group

Pingback: sport4x

Pingback: qiuqiu99 link

Pingback: 스트리머 도네이션

Pingback: ติดเน็ตบ้าน ais

Pingback: visit website

Pingback: รับทำ SEO

Pingback: fryd vapes

Pingback: ราคาบอล1x2

Pingback: ทัวร์หลีเป๊ะ

Pingback: แคลคูลัสมหาลัย

Pingback: sudoku

Pingback: บาคาร่า

Pingback: openlims.org

Pingback: สล็อต pg เว็บตรง แตกหนัก

Pingback: ป้ายโฆษณา

Pingback: ขายบ้านพัทยา

Pingback: Hunter898

Pingback: huayyim

Pingback: พิมพ์ฉลากสินค้า

Pingback: slot gacor

Pingback: Night Bazaar Chiang Mai

Pingback: enkele plooi gordijnen

Pingback: meja 365

Pingback: ข้อดีเมื่อใช้บริการกับ ค่าย SPINIX

Pingback: poker-info.net