What is the Ride-Hailing Economy look like in Pakistan?

Hello friends, colleagues and co-consiprators (& Eid Mubarak in advance to those celebrating!)

For me, I’ve got the journey to and from work (I live in Rawalpindi & work in Islamabad) down to a science. A couple of minutes over the “right time” to leave the capital mean at least two hours stuck at various points on the road. No matter which urban city in the world you may be living in, traffic congestion is probably not an alien concept to you. But for many more developed parts of the globe, there are multiple mass public transit options and the ride-sharing economy is centered around convenience, environmental benefits and reaching where public transport can’t, a.k.a. your doorstep (#FirstWorldProblems).

However, in a country like Pakistan which has been operating sans any mass transit system and where security, especially for women, remains a huge issue, the entrance of ride-hailing apps has been about having access to mobility more than anything else. The much cheaper rates are the cherry on-top for a public that loves a bargain and is extremely price-sensitive, (although if the government gets its say, that benefit may soon disappear – you can read more about the government’s decision to regulate the sector through fixed fares in the aftermath of strikes by taxi drivers here.)

While the introduction of ride-hailing in Pakistan has actually led to an increase in the number of cars on the road (people have actually bought extra Japanese/small fuel efficient cars to be solely used for ride-hailing as an extra source of income), if you are a cautious optimist like myself you know things have to get worse before they get better. This too shall pass and as we see the option to “car-pool” become available to riders (i.e., share rides with other riders versus ride-hailing, where a customer hires a driver to take them to their destination), congestion will subside. However, having access to alternative and reliable transportation options is not only about reducing traffic congestion, but according to a study by Harvard University, access to reliable transportation is the biggest factor that can help pull someone out of poverty.

Our team at Invest2Innovate recently conducted a small research exercise where we interviewed drivers for ride-hailing apps Careem and Uber in Peshawar, Islamabad, Karachi, and Lahore. Of the drivers interviewed, 53.5% drove for the companies because they were otherwise unemployed and this was their only form of livelihood. An additional 40% drove to make extra money (More on this research in the next section of this newsletter). Given these facts, it’s extremely short-sighted of the government to seek to regulate fares in the sector. A better approach would be to take a leaf out of Summit, New Jersey’s playbook where the city decided to partner with Uber to get commuters to and from local rail stations. The result was the administration successfully avoiding spending taxpayer money to fund a new parking garage. In the absence of other public transportation options (Let’s face it, the MetroBus is limited both in reach and capacity to address the problem fully), creative agreements can be made that have far-reaching economic and environmental benefits.

There is also next to no public transport infrastructure and the local taxis/buses are often in bad condition, don’t have operating air-conditioning and charge much higher fares. Careem’s recent round of funding from China’s largest mobile transportation platform, DiDi Chuxing, bodes particularly well put in the context of the ride-hailing economy having proven to be one of most successful online business models in the country (e-commerce while on the rise, is still struggling) and also increasing interest from China to invest in Pakistan. The key may lie in the government becoming an integral part of the equation (private-public partnerships anyone?). So far China has been more keen to deal with the government versus working/investing with private corporations.

The market and sector has immense potential and opportunity, beyond just cars, but also rickshaws (Shahi Sarwari is a notable player) and motorbikes (Bykea & HumBike are new startups), which cater to different socioeconomic demographics. What remains to be seen is if local stakeholders and companies will play their cards right. In the next section we take a look at the recent consumer-side research released by Rozee.pk on ride-sharing. We also carried out a fun, short research exercise where we took Uber and Careem rides and interviewed drivers in Islamabad, Karachi, Lahore and Peshawar (only Careem is available in Peshawar right now). Read on to sift through some of the key insights from our interviews and what comes through when consumer-side data is put together with supply-side information.

Read on for more on trends and investment activity within the fintech, especially payments, space and as always write back with feedback and suggestions. Also have more to say on the topic? Or just share some interesting research/articles with us? Give us a shout!

Cheers,

Anusheh Naveed Ashraf

Head of Insights, Invest2Innovate

i2i Research Spotlight: Pakistan Ride Hailing

In the previous section I talked briefly about the Rozee.pk research on consumer preference and behaviour when it comes to ride-sharing apps. While the research was primarily conducted only in Karachi and Lahore (800 respondents), some of the results are really interesting. When i2i decided on the theme of this month’s Insights newsletter, we thought it might be interesting to also do some small-scale research on driver perspectives. We tried (& failed to collect data via twitter & fb polling – hey! we live to learn) and then decided to go to the source directly. Over just two days, i2i’s team and volunteers took rides and interviewed 14 Uber and Careem drivers (majority of them in Islamabad). We’re definitely not trying to say that the results of this research are robust, complete and generalizable but we do think that they bring forward some interesting insights. Furthermore, these results highlight that there is room for much more research and exploration in the sector.

- In Rozee’s research, one of the insights is that 70% of Careem users believe that the “vehicles are in better condition” versus just 30% of Uber users. In our interviews with drivers we find that this may very well be the case as drivers identify Careem as having more stringent car checks via a company called “car show”. Careem also offers various tiers of car types, while Uber cars all fall under one category UberGo.

- Consumers identified Careem as being the pricier of the two. This perception was reflected in our interviews with drivers as well. A majority of the drivers identified Careem as being more lucrative for the drivers in terms of fares. Many drivers believed that more customers were registered with Uber. Do the numbers match the perception? It would be very interesting to do further research to find out.

Some additional insights from our interviews with drivers:

- Generally, drivers are more satisfied with whichever app they use if they are both the vendors (owners) and drivers of the cars. 53.3% of our interviewees were both and 46.7% were only drivers.

- While in places like the US, often drivers drive for both the top companies i.e. Lyft and Uber. In Pakistan, a majority drive for one app only. This has to do with the fact that bonuses are attached to number of rides and this incentive acts as enough of a pull for drivers sticking to one app only. It would be interesting to do a comparative study to see if the bonus incentive varies among countries and its implications on how ride-sharing is evolving in the local context.

- Only one of our respondents stated that he drove for both Uber and Careem. He preferred driving for Careem because of the better incentives and his main grievance with Uber was that the radius of rides is sometimes too far. Interestingly, a few other Uber drivers also had the same concern. In Rozee’s survey, Uber wins out when it comes to less wait-time (53% of respondents voted for Uber). Uber is also considered the more popular app by a slight margin i.e. 49% vs Careems 47%. The drivers also believe that Uber has more customers. This makes for an interesting investigation point about the customer density in different areas. More customers should in simplistic terms mean smaller radiuses, no?

- In our interviews, we found one driver each that had driven for Uber and switched to Careem and vice versa. Interestingly, both believed that the customers of the app they switched to were better and more civilised. For the driver that switched from Careem to Uber, this opinion held despite the fact that his ID was blocked by Uber due to an unfair (in his opinion) complaint by a user.

- Overall, driver perception on whether the customers or drivers are favoured more by the companies were a 50/50 split. However, a majority of Uber drivers (83.33%) believed that the company treated both drivers and customers equally compared to only 33.33% for Careem. Another interesting factor was that a majority of the Uber drivers were owners of the cars as well. For Careem, a majority were just the drivers, with the owners being a third party. Is this a deeper trend or just a result of a small sample size?

- Uber drivers all thought a feature like Careem Wallet where one could add the balance directly to the app was something that was much needed for Uber, especially because drivers often don’t carry change for passengers and customers cite this as a major issue.

- The navigation system (i.e., GPS) was identified as a major problem (for every city outside of Islamabad, where streets are clear cut) by almost all the drivers from both companies.

- Perhaps the insight that surprised me the most from our interviews, was that drivers overall believed that the majority of customers are good and that they value the conversations they get to have with customers from different backgrounds. I guess I had assumed that the journey would work much like a metro cab and taxi experience where the driver and rider don’t really talk apart from confirming destinations and fares. The interaction among drivers and riders in ride-hailing apps is a notable shift.

There is a lot of additional data that can be gathered and explored, which can help both the companies improve their service and driver/user experience and also help investors understand the sector much better. The good news is that this is exactly the kind of work i2i does, so if you/your company is interested in doing a more in-depth study shoot us an email at aashraf@invest2innovate.com.

CB Insights published this Company Social Graph to take a deeper look at the investment being pumped into and out of the top-5 most well-capitalized Transportation Network Companies (TNC’s). The bold lines represent investments made from one to another of the 5 ride-hailing companies. Greater analysis of the investment activities can be found here.

Talking Data

9 – the number of unicorns, companies valued at $1B+, in the ride-hailing and sharing economy.

8 – DiDi Chuxings investments in on-demand companies. This includes the top 5 TNC’s (Transportation Network Companies) Uber, Lyft, Grab, Ola and Uber China (which is considered a separate entity).

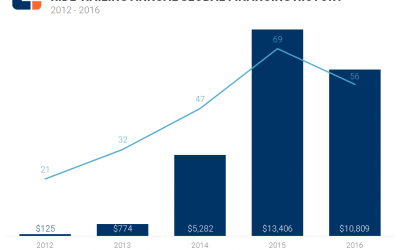

$10.8 B – total investment raised by ride-hailing/sharing companies globally. The investment was made via 56 deals.

33% – ride-sharing deal share has gone to Asia countries – 16% China, 12% India and 5% Singapore.

Pingback: Anavar Vorher Nachher

Pingback: bonanza178

Pingback: bonanza 178

Pingback: bonanza178

Pingback: mejaqq

Pingback: buy iget cats

Pingback: aksara178

Pingback: dried porcini mushroom woolworths

Pingback: dried mushrooms woolworths

Pingback: Luxury Villa Phuket

Pingback: buy Ecstasy on line united states , Canada , united kingdom , Europe , Australia

Pingback: alpha88 pc

Pingback: togel singapore

Pingback: สายใยลวด

Pingback: ป้ายโฆษณา

Pingback: เว็บพนันบอล ถูกกฎหมาย

Pingback: nagaqq poker

Pingback: fryd bar

Pingback: บริการรถเฮี๊ยบตลอด 24 ชม.

Pingback: iwi firearms for sale

Pingback: เสาเข็มไมโครไพล์

Pingback: bonanza178

Pingback: psilocybin capsules for sale

Pingback: Zlurpee 8000