Breaking Down the Buzzword

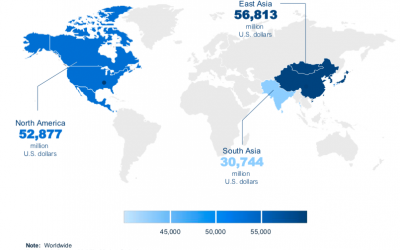

Mobility is a frequently used buzzword in the startup ecosystem, but what does it truly encompass? Mobility-as-a-Service (MaaS) includes car-sharing, ride-sharing, ride-hailing, food delivery, micro-mobility (bikes and rickshaws), and other transportation network companies. The mobility space has seen sharp growth globally, with USD $50 billion invested into ride-hailing startups since 2013. While the market opportunity is enormous worldwide, Asia leads the way, with East Asia expected to remain the largest market globally. Statista Mobility Market Outlook estimates this market will grow from USD $56.8 billion to $105 billion, serving 700 million customers by 2023. South Asia follows closely with a market of USD $30.7 million. Let’s delve deeper into Pakistan’s mobility opportunity.

What is Going on in Pakistan’s Ride-Hailing Landscape?

The Rise of MaaS in Pakistan

The MaaS sector in Pakistan took off significantly in 2015 with Careem’s entry into the market. By 2018, Pakistan was Careem’s second highest source of rides among the 14 countries it operates in. Uber entered the Pakistani market in 2016, igniting fierce competition with Careem. This competition was a defining moment for Pakistan’s mobility industry.

Local and Global Entrants

Bykea, a motorbike-hailing company launched in 2016, leveraged an active network of motorbike owners to transport people and parcels. Bykea caters to lower and middle-income segments, with an app in Urdu and voice notes to facilitate reach across audiences. Bykea announced a $5.7 million Series A round in 2019. (Side note: Bykea was a case study in i2i’s 2019 Pakistan Startup Ecosystem report, which you can read here). Roshni Rides and Paxi, which launched in 2017, specifically address mobility barriers for female users, offering services designed for women. Roamer, an on-demand car rental service, launched in 2018, offering chauffeur-driven rentals similar to Zoomcar in India.

Disrupting Mass Transit: Airlift & Swvl

Innovations in Mass Transit

Airlift and Swvl, which emerged in 2019, aim to disrupt mass transit in Pakistan. Airlift operates in Lahore and Karachi, while Swvl operates in Islamabad, Lahore, and Karachi. Airlift announced a $12 million Series A round in 2019, the largest in Pakistan, bringing in international investors like First Round Capital. Swvl announced plans to invest USD $25 million in Pakistan, emphasizing the competition in this space. Both startups target consumers who would otherwise use regular public transport.

Insights from Key Players

Key Takeaways from Conversations with Industry Leaders

Our Insights team spoke with Gia Farooqi (CEO of Roshni Rides), Shahzeb Memon (General Manager of Swvl), and Ahmed Ayub (Co-Founder of Airlift) about recent developments, opportunities, and gaps in Pakistan’s mobility landscape. They unanimously agreed that the mobility problem in Pakistan is significant enough for multiple players to solve, pointing to weak public infrastructure and digital penetration as areas for startups to fill the gap.

Memon (Swvl) and Ayub (Airlift) highlighted the importance of collaboration with the public sector to ensure service accessibility. Recent collaborations, such as Swvl’s partnership with the Sindh government and Airlift’s MoU with the Ministry of Science and Technology to introduce electric buses, indicate support for innovation in the sector.

Farooqi (Roshni Rides) emphasized the importance of inclusivity, noting the challenges of running a startup as a young woman in Pakistan.

A Consumer’s Perspective

User Experience Insights

We gathered qualitative data from volunteers who used Airlift and Swvl for a week in Karachi, Lahore, and Islamabad. Key factors influencing user preferences included convenience (pick-up points), cost, quality of experience (driver behavior, car cleanliness), and ease of payment. Swvl rated higher in convenience, low cost, and comfort, while Airlift scored higher in ease of payment, punctuality, user-friendliness, and geographical radius.

Talking Data

Investment Figures

- $771.7 million – amount raised by Careem in funding across 7 rounds before being acquired by Uber in 2019.

- $5.7 million – raised by Bykea in a Series A round in 2019.

- $14.2 million – total amount raised by Airlift in 2019 via seed and Series A rounds.

- $80 million – amount raised by Swvl from 2017 to 2019 in four funding rounds. Swvl has allocated $25 million to Pakistan.

The Importance of Stickiness

Building Customer Loyalty

Building strong customer relationships is critical for MaaS companies to retain users. Companies like Uber and Careem offer loyalty incentives. For instance, Careem’s loyalty program rewards frequent users with points that can be redeemed for various services. Similar incentives could help startups like Swvl and Airlift retain customers, though maintaining customer loyalty requires significant investment.

More Insights from us next month, or rather, next year. As always, drop us a line and let us know how we’re doing, things we’re missing, and topics you’d like to see. Until 2020, this is the i2i Insights team signing off.

Pingback: 티비위키

Pingback: buy magic mushrooms online australia

Pingback: magic mushrooms for sale online australia

Pingback: นำเข้าสินค้าจากจีน

Pingback: ราคาบอล สูง/ต่ำ

Pingback: เว็บ รวม คา สิ โน คาสิโน

Pingback: fryd carts for sales online

Pingback: Hack google

Pingback: qiuqiu99 slot

Pingback: แฮนดิแคป

Pingback: macaw parrots

Pingback: bonanza178

Pingback: chloroform kopen

Pingback: ข่าวกีฬา

Pingback: ทินเนอร์คุณภาพสูง

Pingback: หวยอภิโชค

Pingback: slot88

Pingback: varning för lyrica

Pingback: สล็อตbetflik

Pingback: Fn America guns

Pingback: villas in phuket thailand with private pool

Pingback: เครื่องกรองน้ำ coway

Pingback: yehyeh com

Pingback: paito sgp

Pingback: togel resmi

Pingback: POLKADOT MUSHROOM CHOCOLATE

Pingback: QUALITY BOURBON WHISKEY

Pingback: FRYD FLAVORS - FRYD - FRYD CARTS - FRYD EXTRACTS

Pingback: QUALITY BOURBON WHISKEY

Pingback: gold coast clear summer edition - Vape Carts World - lost mary vape

Pingback: VAPE CARTS COLLECTION