Snapshot of Travel & Tourism Industry in Numbers

Pakistan has emerged as a major tourist destination, recognized by prestigious platforms like Conde Nast and Forbes. With Pakistan topping Conde Nast’s list of exciting travel destinations for 2020 and being featured in Forbes’s ‘best under-the-radar trips of 2020’, the tourism sector is poised for significant growth. According to Gallup Pakistan, tourist traffic at cultural sites in Pakistan increased by 317% over the past five years, with Punjab contributing nearly 95% of this growth. Additionally, the Pakistan Tourism Development Corporation (PTDC) reported that 17,823 foreign tourists visited Pakistan in 2018, up from 10,476 in 2017.

Innovations in Tourism Industry

The Role of Startups in Catering to Tourists

In response to the growing influx of tourists, startups in the travel tech landscape are stepping up. Direct contribution of travel & tourism to Pakistan’s GDP was 2.9% in 2017, with domestic travel spending accounting for 93.2%. This indicates a significant opportunity for innovation focused on domestic travelers, though foreign visitor spending (6.8%) also shows potential for growth.

Key Travel Tech Startups

Startups like Sastaticket, Bookme, FindMyAdventure, EasyTicket, GoGhoom, TripKar, Porter Pakistan, and Yugo are meeting the demand for online search and booking services. For instance, Sastaticket raised $1.5 million in Series A funding from Gobi Ventures in November 2018. Bookme.pk, which pioneered e-ticketing in Pakistan, offers services in buses, theaters, and events, and raised pre-Series A funding from Lakson Investments Venture Capital (LIVC) in 2019. These startups provide users with digital solutions for booking and payments, significantly improving the travel experience.

The Importance of Digital Literacy and Early Adopters

With a literacy rate of 58% and mobile data penetration of 35.21%, engaging early adopters is crucial for the success of travel tech startups. Creating clusters of early adopters can help transition more users to online portals. E-ticketing startups should leverage their network of partners, such as bus operators, hotels, and airlines, to endorse and incentivize using e-platforms.

Alternative Lodging: A Growth Area

Local Startups in Alternative Lodging

Roomy and Ghumo are local startups providing alternative lodging options by partnering with existing properties. Roomy revamps properties to offer affordable stays, while Ghumo offers short-term rentals similar to Airbnb. These models are more inclusive and sustainable, helping local property owners monetize their assets and distribute economic gains from tourism.

High-Growth Startups in Pakistan’s Tourism Industry

Notable Startups and Their Impact

Bookme.pk, Sastaticket.pk, and FindMyAdventure are notable high-growth startups in Pakistan’s tourism industry. These startups are capitalizing on the increased familiarity with digital payment tools and the rise in global tourism rankings. Faizan Aslam (Bookme.pk) and Shazil Mehkri (Sastaticket.pk) emphasize the unprecedented opportunities for designing creative solutions in the tourism space.

Global Inspiration and Personalization Trends

Indonesian startups received 70% of the global travel tech funding in 2019, with Traveloka being a prominent player. Indian travel tech startups like TravelTriangle also offer valuable insights due to demographic similarities with Pakistan. Personalization, driven by data insights into customer behavior, is a major trend in the industry. However, there is a need for more data-driven research to understand and cater to the growing demand in Pakistan.

The Future of Travel Tech in Pakistan

Leveraging Data for Personalization

Personalization entails customizing services based on travel patterns and customer needs, which requires data-driven insights. Despite the potential, there is a dearth of data and research in Pakistan’s tourism industry. Increased investment in data collection and analysis is necessary to localize and personalize learnings from the global travel tech space.

Conclusion: Unleashing Market Potential

The Pakistani travel tech space has the potential to leapfrog through increased digitization and innovation. Engaging early adopters, leveraging partnerships, and focusing on personalization are key strategies for success. As the sector grows, it is crucial to conduct more data-driven research to fully understand and meet the needs of both domestic and international travelers.

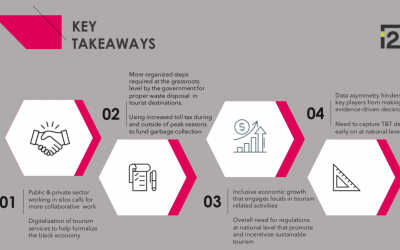

Image of Interest

Note: The i2i team spoke with startups founders and other key stakeholders about the disruptive and innovative approach to unleashing the current market opportunity in the travel industry. The people we interviewed include Faisal Aftab (Lakson Investments), Faizan Aslam (Bookme.pk), Umar Farooq (Tech Valley), Neelam Azmat (PPAF), Afia Saleem (Climate Journalist), Aneeqa Ali (The Mad Hatters), Haseeb Sattar (GoGhoom), Aun Ahmed (Ghumo), Bilal Mehkri (Sasta Ticket), and Abu Bakar Niaz (Caravan Pakistan). While we might not have disaggregated each of the participants’ responses in the newsletter, our overall analysis distilled the most important learnings from our conversations. We acknowledge and appreciate everyone’s contribution to our work.

As always, drop us a line and let us know how we’re doing, things we’re missing, and topics you’d like to see. We will be back soon with more interesting insights. Next month’s newsletter will be a comparative analysis of the startup ecosystem in Pakistan versus Bangladesh. If you have any suggestions or comments on that, do tell. Until then, this is the i2i Insights team signing off!

Pingback: ข้อมูลแหล่งที่มาของ หวยอภิโชค

Pingback: คอนโดพัทยา

Pingback: Buy Vape carts online

Pingback: โซล่าเซลล์

Pingback: meja 365

Pingback: ร้านขายเครื่องมือแพทย์ในอุดร

Pingback: ccaps.net

Pingback: Relx Infinity

Pingback: super kaya88

Pingback: สล็อตเว็บตรง

Pingback: Native Smokes

Pingback: yehyeh

Pingback: ป้ายนครราชสีมา

Pingback: ป้ายมอเตอร์เวย์

Pingback: Jav

Pingback: click here

Pingback: Skrota bilen Göteborg

Pingback: สมัครแทงบอล 2LOTVIP

Pingback: Hunter898

Pingback: สล็อตเว็บนอก

Pingback: fxtm